5 Invoicing Challenges that Request is Tackling with Blockchain Technology

Manual tasks, compliance risk, not being paid... How Request Invoicing is tackling these challenges.

👋 Request enthusiasts,

Small and Medium-sized Businesses (SMBs) presently are stuck in terms of invoicing in the traditional industry. While the world is seeing a growing adoption of digital currencies mainly by end-users, most businesses still can’t make the most out of crypto technology easily. Undoubtedly, blockchain is bringing real-world benefits for transactions in an open and decentralized network. However, there are still risks involved around inexperienced users with the technology and a lingering skepticism from the use of cryptocurrency as means of payment. Businesses are seeking more certainty and transparency with the help of a reputation system and to have access to more financial services. Read further on how Request and specifically its Request Invoicing App are tackling these challenges.

Summary

- SMBs, freelancers, crypto organizations & DAOs need better invoicing

- Blockchain is one of the most promising technologies, yet still involves risks due to manual tasks

- Despite the attractiveness of Crypto & DeFi, businesses perceive a compliance risk

- The invoicing actors are not fighting the risk of not being paid

- The financing options for businesses are almost nonexistent

1. SMBs, freelancers, crypto organizations & DAOs need better invoicing

There are problems to solve in the invoicing and payments space. One of the most obvious ones being the lack of openness and interoperability between systems. Opening a bank account or using a bookkeeping software feels like committing forever with a similar feeling as the one we have when facing a choice between Android and iPhone.

Payments can be expensive and slow, especially when dealing with them internationally.

There’s also a lack of innovation. When the best invoicing software charges a premium fee for uploading a logo, that means there’s not much innovation happening in this industry.

The invoicing software relying on the Request core technology can make the most out of blockchain. Each invoice is an object whose unicity can be proven at any time. That makes many innovations possible such as implementing an escrow system where we replace banks with code; or approving invoice financing in seconds based on the companies reputation score; or matching payment and invoice records instantly.

2. Blockchain is one of the most promising technologies, yet still involves risks due to manual tasks

For a business to make a payment to another business in the traditional world, it would require the other company’s bank details, company name, address and government-issued identification number.

Businesses would also need to draft and sign contracts before starting a business relationship, particularly for legal protection against non-payment.

With blockchain payments, all that is needed to send funds is a recipient address. However, these addresses are not so easy to read, exchange and handle safely in everyday operations. Sending funds to the wrong address is irreversible and can lead to loss of funds. Copy-pasting is the weakest link of your financial security. At today’s valuation, we estimate that ~150 billion dollars of Bitcoin have been lost forever.

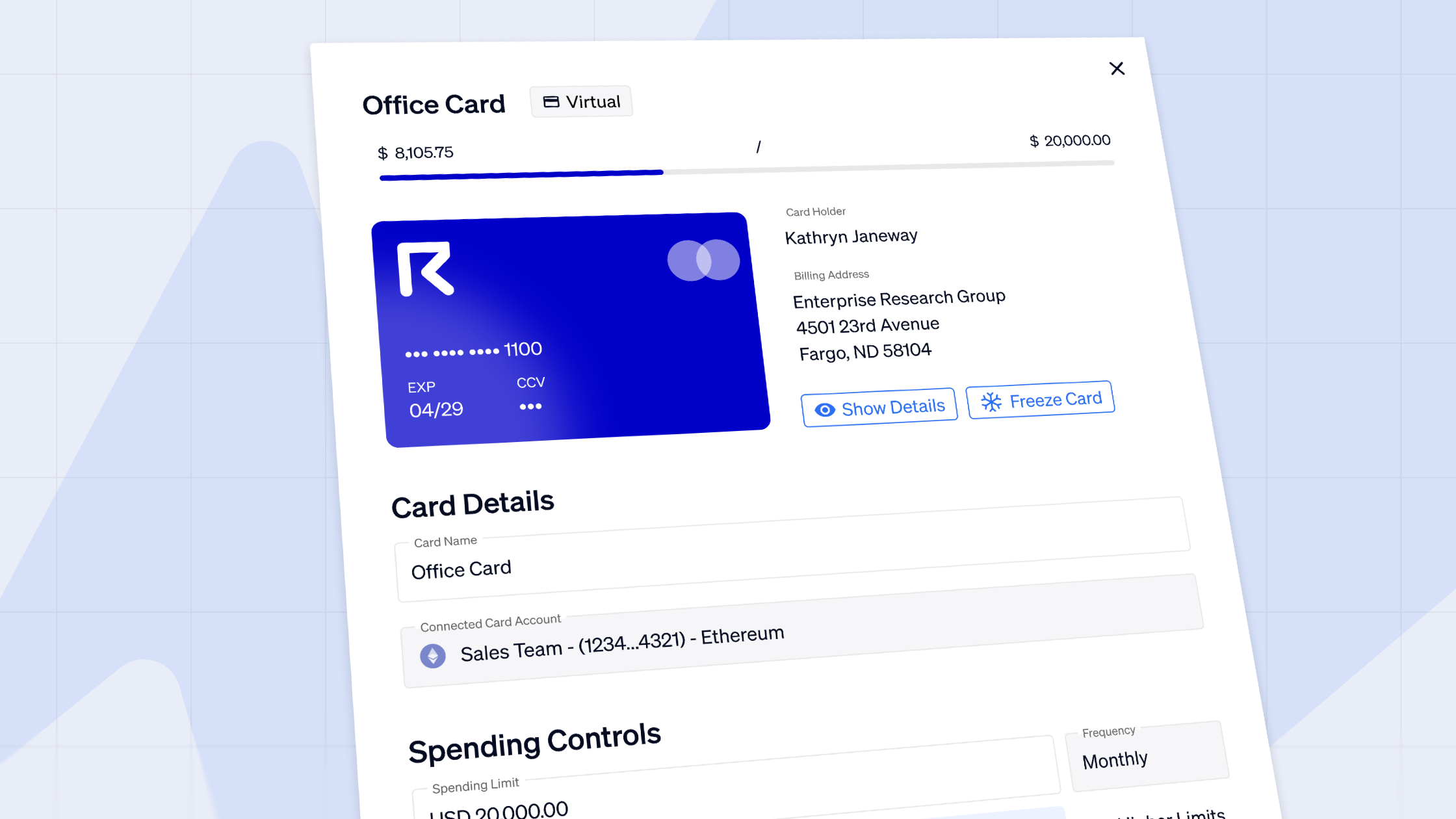

With Request Invoicing, the problem with cryptocurrency addresses can be avoided. Crypto payments can be done in a safer way, without ever handling anything manually. Paying an invoice is almost as easy as a one-click Amazon checkout. Here is a video explainer.

3. Despite the attractiveness of Crypto & DeFi, businesses perceive a compliance risk

The regulatory authorities, the financial institutions and banks have not yet shown a clear approval towards cryptocurrencies. However, that did not prevent German and American banks from applying for cryptocurrency custody. The most popular news media did not show much interest in demonstrating how life changing cryptocurrencies and DeFi can be for society. It certainly goes without saying that blockchain doesn’t come free from risk, but it also brings advantageous and revolutionary technology that will pave the road to more financial freedom.

Cryptocurrencies have sometimes been seen as shady and used only for devious means. There seems to be a lack of compliance and a fear of cryptocurrencies coming from some accountants, auditors, businesses and individuals.

Yet, the recent progress made by Tesla shows that it’s possible to be a large corporation and compliantly benefit from crypto. Nevertheless, more and more businesses and individuals are entering the new monetary world in order to diversify their portfolio or benefit from the payment experience.

Plus, there are solutions to achieving regulatory compliance. With Request Invoicing, businesses can associate a proper blockchain invoice to every transaction. Therefore, sending to their now happy accountants the exact same format as what comes from Xero, Quickbooks or any other modern invoicing software. And that’s not all, some banks allow businesses to receive FIAT funds from crypto exchanges as long as they can justify the source of funds with a proper invoice like the ones issued through the Request Invoicing app.

4. The invoicing actors are not fighting the risk of not being paid

Not getting paid on time (or even at all) can be a high risk for small businesses and a growth limitation factor for that matter. Traditional invoicing tools are doing their best to help solve this problem but their business model is based on subscriptions and there isn’t a virtuous incentive in having their users to get paid on time.

Request believes an open reputation system will help reduce the risk of not getting paid. It will reassure the invoice issuer and facilitate the invoice payer to commit in processing their payments. And here’s how we’ll implement it.

On the Request Invoicing app, the acceptance of invoices is time stamped on the Ethereum blockchain. This status is immutable. Every invoice gets an “accepted” status if the client receives and approves it. Additionally, the invoice payer’s reputation increases if the payment is made on time or in advance. With a good payment reputation, it’s easier for a business to work with the best providers and receive special discounts from their suppliers. Everyone is incentivized to behave well. This is the solid foundation for a virtuous financial system.

5. The financing options for businesses are almost nonexistent

1.7 billion people are unbanked. The banking system does not serve them. We need more financial inclusion for people. We need access to loans and we need more fairness. The good news is that those people are going to find solutions thanks to blockchain technology, cryptocurrencies and digital wallets.

Some businesses are also unbanked or only partially served depending on the industry or country they operate in. When the fintech movement started, the startups in this industry had a hard time opening a bank account. Today, the companies in the crypto space still struggle to access financial services.

Additionally, banks don’t easily offer loans to SMBs and bear in mind that 99% of the companies in the US are SMBs. Indeed, the banking industry needs to make sure that the one receiving a loan will be able to reimburse it. This is unfortunate for startups and small businesses because they’re not considered a safe borrower for banks.

One of the solutions to tackle such a problem is invoice financing. “Invoice financing is a way for businesses to borrow money against the amounts due from customers. Invoice financing helps businesses improve cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they had to wait until their customers paid their balances in full.”.

However, companies that have the privilege to get financing from their invoices are rare. Indeed, if they don’t have an excellent reputation for a few years or a reputable customer, the banks won’t often take the risk. It’s no surprise that the number one reason why startups fail is the lack of cash. And when they get financed, it would take a few months for the due diligence to process.

Businesses and freelancers also deserve financial inclusion thanks to a fair and open system of invoices that would allow anyone to finance their invoices in a decentralized way. For example, a MakerDAO freelancer whose invoice has already been approved by the DAO could be financed by the community in seconds based on his or her reputation in exchange for a small fee. All this thanks to a decentralized network of payment requests – without the need of an approval from banks.

Most crypto invoices between businesses involve manual work and spreadsheets. Companies that already send and pay invoices in crypto can use the Request Invoicing app for its easy-to-use experience, its reconciliation dashboard and for the potential new features. Request is one of the rare Corporate DeFi players to help freelancers, businesses & DAOs.

Learn more

about the REQ token: https://request.network/en/2021/02/25/request-req-token/

about Request vision: https://request.network/en/2021/02/23/request-overview-ambitions/

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.