Updated in January 2024, with the addition of freelance jobs that pay the most in crypto.

Chances are, you may have already been asked by some clients whether you accept payments in crypto. Or you may be starting to do some freelance work for a decentralized autonomous organization, or DAO, and need to figure out how to manage freelancer crypto payment.

If you are still on the fence, we previously talked about some reasons why freelancers should not fear being paid in crypto. As a freelancer in this field, it's important to understand the various tools and options available for accepting freelance crypto payments.

This article will cover:

- The basics of getting paid in crypto

- How to get paid in crypto

- Tools for Web3 freelancers to get paid in crypto

- Tax considerations for freelance crypto payment

- Getting a job in crypto

The basics of getting paid in crypto

Getting paid in cryptocurrency can be intimidating - especially if you are new to the crypto space.

But fret not, accepting payment in crypto is not much more complex than the existing bank or payment apps you already use today. Let's look at some of the similarities between getting paid in crypto, and getting paid using traditional payment services.

We'll also look at things for freelancers to consider about each of the three different aspects of getting freelance paid in crypto: currencies, accounts & wallets, and payment networks

1. Currencies

Especially when you travel to a different country or shop online, you may be asked at the point-of-sale, or at the checkout page what currency you would like to pay in. The same is true when a freelancer get paid in crypto.

Just like there are different national currencies, there are different types of cryptocurrencies that you can make and accept payments in.

- What types of cryptocurrencies can I get paid in?

Three of the most common types of cryptocurrencies freelancers will be offered payments in are: (i) stablecoins, (ii) utility tokens, and (iii) governance tokens.

Stablecoins are essentially cryptocurrencies that mirror national currencies like the USD, or EUR. Utility tokens like ETH, or BTC are specific types of cryptocurrencies that perform specific functions on their native blockchain networks. Apps built on different blockchain networks often also issue their own utility tokens that function much like in-game currencies, or casino chips that can only be used within a specific environment. Governance tokens are a specific type of utility token which gives you voting rights in a DAO or community.

- Things to consider when choosing a cryptocurrency to get paid with

When considering what cryptocurrencies to get paid in, one of the most important factors to consider is volatility. Stablecoins are the least volatile in price as they are intended to function much like digital cash. Utility tokens and governance tokens are usually highly volatile, and can see wild upticks, or crashes in price.

Most freelancers getting paid in crypto will often opt to take payments largely in stablecoins to ensure that their savings don't see sharp drawdowns in value. But you can also consider getting paid partially in utility or governance tokens.

This allows you to profit from potential price appreciations, but more importantly, utility tokens are also needed to pay network fees required to transact on blockchain networks.

2. Accounts & Wallets

In traditional payments you will need a bank account to send and receive payments. A bank account is nothing more than a digital record of the cash deposits that the bank promises to return to you on-demand. Note: most of the money isn't actually there.

To get freelance paid in crypto, you will need to use a crypto wallet. It functions much like any digital wallet you may already have on your phone. But there is a key difference. Unlike a bank account, or a digital wallet with PayPal, Revolut, or Wise - a crypto wallet is a reflection of assets you actually have full control and possession of.

A crypto wallet is more like a safe deposit box, while a bank account or digital wallet is more like the receipt you get for giving your car to a valet service. Except if the valet service could also rent out your car to Uber drivers, or for pizza delivery.

- What types of crypto wallets are there? Things to consider when choosing crypto wallets.

Two of the most important considerations when choosing crypto wallets are security, and access control.

Is it connected to the internet? If yes, then it is a "hot wallet". Hot wallets are convenient because they allow you to quickly and easily access your coins. They are the most common type of wallet, and are ideal for storing "petty cash" in crypto, or for trading on exchanges, and interacting with decentralized apps. However, because they are connected to the internet, they are also more vulnerable to hacking.

Cold wallets are not connected to the internet. They are less vulnerable to hacking, but they are not as convenient because you cannot access your coins as quickly. The most common type of cold wallet is a hardware wallet: a physical device that stores your crypto keys. Hardware wallets are very secure because they are not connected to the internet and are difficult to physically tamper with.

Who controls the private keys? If you alone control the private keys, the wallet is a self-custodial wallet. When you own and manage your own private keys, you alone have complete control over your assets. However, that is not to say that there are no risks! Anyone with the private keys can access that wallet.

If you do not control the private keys, it is a third-party hosted, or custodial wallet. Most wallet addresses on centralized exchanges like Binance or Coinbase fall into this category. You are depositing funds into a crypto wallet whose private keys do not belong to you.

In effect, the institution which controls the private keys to the wallet is either acting as a trustee, or a borrower. The former cannot do anything with your assets - except as instructed, the latter can. In cases like FTX, a custodian may claim to be a trustee, but in fact is fraudulently using your assets in violation of that trust.

Having a hard time deciding which type of wallet is right for you to get paid in crypto with? You can simply use a mix of wallet types. That way you can have your cake and eat it too.

3. Payment Networks

As a freelancer, you will at some point have been asked what payment methods you accept. Merchants who accept card payments in physical retail settings, also have to decide what payment networks like Visa, or Mastercard to get paid with.

When getting paid in crypto, rather than asking for your bank or preferred payment app, you will often be asked what blockchain network, or "chain", you want to use.

- What types of blockchain networks are there?

Broadly speaking, there are Layer 1, and Layer 2 blockchains. Layer 1 blockchains include things like Ethereum, and alternative Layer 1s that attempt to compete on speed, security, and cost. In general, layer 2 blockchains attempt to improve on the limitations of their underlying Layer 1 chains.

Not all blockchain networks are interoperable. For instance, the Bitcoin and Ethereum network. That means if you wanted to pay an Ethereum wallet address with BTC, you would have to use a "bridge".

- Things to consider when choosing blockchain networks

There are four main considerations when choosing a blockchain network to get paid in crypto: cost, speed, reliability, and bridge security.

All payment networks - whether card payments, bank transfers, or blockchain networks incur various types of fees. The main difference lies in the amount, and complexity of the fees being charged. Traditional payment methods will incur credit card fees, merchant fees, interchange fees, administrative fees, and currency conversion fees. These fees are not only costly, but often confusing and opaque.

In contrast, crypto payment networks charge a "gas" fee for making a transaction on a blockchain, while exchanges charge a currency conversion, or "swap" fee. Fees are transparent, shown upfront, and often cheaper than traditional cross-border payment methods, especially if you use more advanced blockchains.

Speed is also another consideration. Depending on which blockchain network you use, payment confirmations can take minutes or seconds to settle. Regardless of which network you go with, crypto payments are almost always faster than cross border payments, especially for larger amounts.

Lastly, you will want to consider reliability. Some blockchain payment networks like Solana have suffered repeated outages for hours at a time.

4. Pros and Cons

One advantage of using cryptocurrency payment networks is transparent and cheaper fees compared to traditional payment methods. All payment networks - whether card payments, bank transfers, or blockchain networks incur various types of fees. The main difference lies in the amount, and complexity of the fees being charged. Traditional payment methods will incur credit card fees, merchant fees, interchange fees, administrative fees, and currency conversion fees. These fees are not only costly, but often confusing and opaque.

In contrast, crypto payment networks charge a "gas" fee for making a transaction on a blockchain, and exchanges charge a currency conversion or "swap" fee, which are shown upfront and are often cheaper than traditional cross-border payment methods, especially if using more advanced blockchains.

Another advantage of getting paid in crypto is speed. Depending on the blockchain network used, payment confirmations can settle within seconds or minutes, compared to traditional cross-border payments, which can take days to settle. Regardless of which network you go with, crypto payments are almost always faster than cross border payments, especially for larger amounts.

It’s worth noting that reliability is also a factor to consider, as some blockchain payment networks have experienced repeated outages that can last for hours at a time.

However, utility tokens and governance tokens are usually highly volatile, and can see wild upticks, or crashes in price. When considering what cryptocurrencies to get paid in, one of the most important factors to consider is volatility. Stablecoins are the least volatile in price as they are intended to function much like digital cash.

Most freelancers who get paid in crypto will often opt to take payments largely in stablecoins to ensure that their savings don't see sharp drawdowns in value. But you can also consider getting paid partially in utility or governance tokens to profit from potential price increases and pay network fees.

Send professional invoices and receive payments in crypto, stablecoins, or fiat - all in one secure, compliant platform.

How to get paid in crypto

1. Wallets

A crypto wallet is the first and most important tool for any freelancer in Web3. It is a secure and convenient way to receive and store your digital assets, like NFTs or cryptocurrencies. Think of them like the crypto equivalent of bank accounts. The wallet addresses act like bank account numbers, and the private keys are like your authentication token.

But rather than list out some popular crypto wallet options here, you should start by thinking about how to choose crypto wallets that meet your needs.

Firstly, you need to determine what blockchain network, and token type do you want to accept crypto payments in? If you are new to crypto, this will largely be determined by the client or Web3 organization you are working with. You need to choose a wallet that can support transactions on your clients’ preferred blockchain, and in the token types you want to hold. For instance, Phantom wallet might be best suited for the Solana blockchain, while Metamask is best for transactions on the Ethereum blockchain.

Secondly, you may also want to think about what you plan to do with the freelance crypto payments you receive. Typically, most people will choose to spend some of it, invest another part of it, while the rest is kept in a virtual safe deposit.

There are different types of wallets like hot or cold wallets - each better suited for different uses. Most freelancers will typically have hot wallets like Metamask that are connected to the internet, which are used to spend or invest their cryptocurrencies. The majority of your crypto savings should be held in a more secure, offline cold wallet like a Ledger.

2. On/Off Ramp Options

Earning in crypto is great, but until it becomes truly mainstream, you will need a way to cash out into a bank account so you can spend it.

An on/off ramp is a platform that allows you to easily buy or sell cryptocurrencies using national currencies that you already have in your bank account. These platforms allow you to easily convert your crypto into fiat currency, making it easier to manage your finances and pay bills with merchants that don’t accept cryptocurrency yet.

Some popular on/off ramp options include centralized exchanges like Binance, Coinbase, and Kraken. They not only allow you to swap between different cryptocurrencies and stablecoins, they also enable you to cash out your freelance earnings to your preferred home currency, so you can spend domestically. Some centralized exchanges also issue debit cards, allowing you more ways to spend your crypto holdings at retail locations in selected countries.

Centralized stablecoin issuers can also act as off-ramp methods. For instance, opening an account with Circle allows you to convert your USDC stablecoins to USD in a bank account at a 1:1 exchange rate. Similarly, if you accept payments in the EURe stablecoin, Monerium allows you to convert your crypto euros into any European bank account via a SEPA bank transfer.

Payment processors like Stripe and PayPal have started to integrate crypto payments options for their users. This allows freelancer crypto payments via these platforms as well as traditional methods.

To understand which on/off ramp methods are best for you, fire up an Excel spreadsheet or table that compares them by withdrawal fees, exchange rate spreads, and withdrawal times.

3. Crypto Invoicing Applications

As a freelancer, it's important to have a reliable invoicing system in place to manage your crypto payments. Invoices are crucial when it comes to billing your clients.

Most freelancers tend to use Microsoft Word documents or Excel templates to create PDF invoices for their clients. But these are not well-suited for sending invoices where you want to be paid in crypto.

Your client has to copy your wallet address, the amount, token type, and blockchain network manually when making the payment. This process is manual, laborious and prone to errors that can lead to delays in you getting paid in crypto.

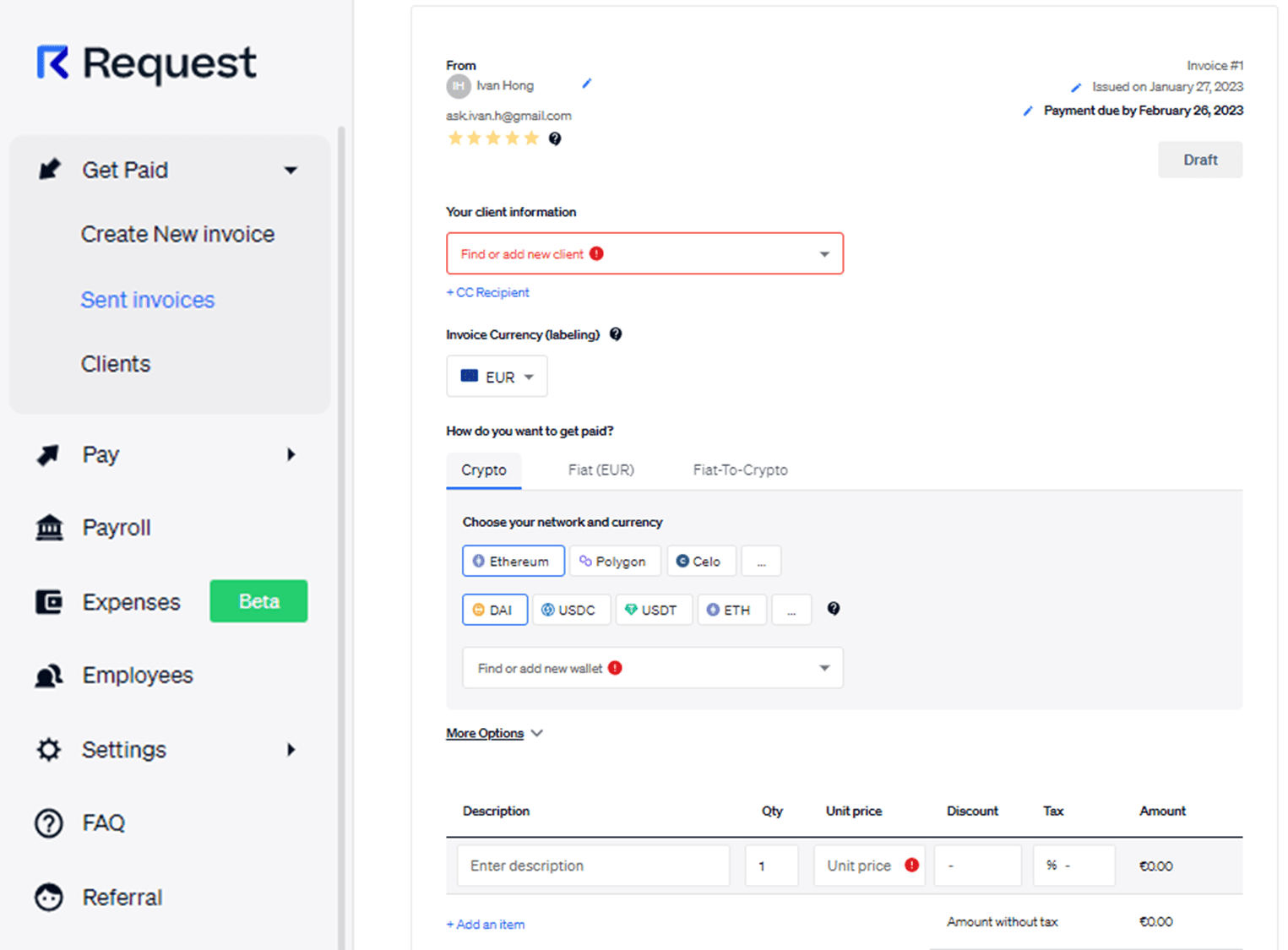

You can automate the way you invoice clients with tools like Request Finance, allowing you to easily pre-set your billing details in crypto. Paying an invoice in crypto can be done in just a few clicks. These applications allow you to easily create and send invoices to clients, and track payments in real-time.

Freelancers can also automatically create, and schedule invoices to be sent at a specific billing date, or even set recurring invoices so you never have to worry about forgetting. You can also schedule automated email reminders that chase clients for payment on your behalf.

If you’re a freelancer who has transitioned to salary work, getting paid in crypto via payroll can be a more convenient option to receive payments. You’ll typically need to provide your client with your crypto wallet address, which they can use to send your payments.

With Request Finance for payroll, your client can make a single batch payment to their employees at once, rather than making individual payments to each employee which can be time-consuming and error-prone. Your client can also set up recurring payments, track real-time and convert currency automatically in a single dashboard. You can now get paid by your client easily in a timely and efficient manner.

Tax considerations for freelance crypto payment

As crypto gains mainstream acceptance, tax laws and regulations are starting to catch up. Freelancers need to make sure they are aware of the tax implications and take steps to comply with regulations. Depending on your tax residency status, you may be subject to both income and capital gains taxes on your crypto earnings, as well as holdings.

Crypto tax calculation tools like CoinTracking, TokenTax and BearTax can help freelancers stay on top of their tax obligations. Taxes aside, for freelancers who must pay taxes to the United States government, reporting your crypto earnings to the IRS and FinCen will soon become mandatory starting 2024.

Using a crypto invoicing tool like Request Finance can also help to simplify keeping track of your crypto earnings in fiat prices using historical exchange rates.

Getting freelance jobs that pay in crypto

For many freelancers, there is no better way to build your portfolio in Web3, learn about the different verticals and projects in the space, all while being paid in crypto.

As you work for various DAOs and projects, you may find yourself interested in working full-time in crypto.

Freelance jobs and gigs that pay the most in crypto can vary depending on the market demand and industry trends. Some of the high-paying freelance jobs that pay in crypto include blockchain development and programming, smart contract development, cybersecurity and auditing for blockchain projects, cryptocurrency trading and investing, content creation and marketing for crypto-related businesses, and consulting services for blockchain startups and organizations.

These roles often require specialized knowledge and skills in the crypto industry, making them more lucrative compared to other freelance opportunities. Additionally, participating in token airdrops or bounty programs can also provide freelancers with opportunities to earn crypto tokens as rewards.

Some questions you may want to consider when thinking about getting freelance jobs that pay in crypto are:

- What mission do you care about enough to spend the next few years working on?

Crypto can be a wild place to work. Pumps and dumps, rallies and crashes, summers and winters, hirings and firings. Ask yourself why you want to be in crypto, and what will keep you here. Having a strong sense of purpose and mission will serve as your north star. It will help you to stay focused amidst the noise, and remain motivated even when things are tough.

- How can you become an integral part of a project's value chain?

As a freelancer, you are a subscription service. Working full-time in crypto means getting a client to find so much value in your service, that they would rather just hire you.

Often, this means thinking about where and how you add value to what a project is doing beyond just piecemeal services. This will help you decide if you can work for a project full-time, or if it is better to stay a freelancer.

- What do you value most in a team?

One of the biggest differences between being a freelancer, and a full-time employee is having to work in a team. Finding the right team that you can work well with can be hard. As freelancers looking to transition to full-time work in Web3, remote-first organizations can be best.

Whether or not you choose to remain as a freelancer, or work full-time in a team, there is a wide range of tools at your disposal to help you get paid in cryptocurrency.

With the right tools in place, freelancers can focus on delivering their services and growing their business, while leaving the logistics of crypto payments to the experts.

%20(1).png)