Comparing The Best Crypto Wallets For Businesses in 2024

Which is the best crypto wallet for business in 2024? Here's a crypto wallet comparison between Safe, Ledger, Metamask, Qredo, Fireblocks, Ledger Enterprise, Coinbase Wallet and Crypto.com Defi wallet.

Updated in February 2024, with the addition of Coinbase, Crypto.com, Fireblocks and Qredo to better compare crypto wallets.

One of the first major decisions new businesses make is deciding on a business bank account.

Similarly, if your business has considered accepting payments in cryptocurrency, you'll need to think about what are the best crypto wallets for businesses.

But be warned - just like personal bank accounts are not designed for enterprise use, not all crypto wallets have the right features that can serve as a crypto wallet for business.

In this article, we will discuss:

- What makes a good enterprise crypto wallet, and

- Perform a crypto wallet comparison for business

So, if you’re a small business owner ready to accept crypto payments but not sure where to begin, this is the right place for you.

Let’s get started!

Here’s a crypto wallet comparison of some of the wallets mentioned below for businesses based on features offered:

What makes a good enterprise crypto wallet?

Businesses need crypto wallets for much of the same reasons that they need a bank account: to collect and manage the company's funds, as well as process payments.

Similar to how business owners maintain separate bank accounts for personal and business finances, it’s important to establish a distinct business entity, such as a limited liability company (LLC), and maintain separate accounts for personal and business finances.

Traditional companies achieve this by setting up a business bank account, while Web3 companies that transact in crypto need to go a step further by setting up a dedicated business crypto wallet LLC.

With all activities being publicly viewable on-chain, reputation becomes easier to lose, and risks such as hacks and market volatility can result in substantial liabilities. Failing to separate your personal and business assets properly puts your personal wealth at stake.

But just as business bank accounts have specific features that cater to the needs of businesses, some crypto wallets have dedicated features that make them better crypto wallets for your business.

Two of the main factors that businesses should consider when deciding on a business crypto wallet are:

1) Cybersecurity: Are Your Funds Safe?

Security is paramount when choosing wallets.

In general, hot wallets are convenient because they allow you to quickly and easily access your coins. They are the most common type of wallet, and are ideal for storing "petty cash" in crypto, or for trading on exchanges, and interacting with dApps.

However, because they are connected to the internet, they are also more vulnerable to hacking. Cold wallets are more secure, but they are not as convenient because you cannot access your coins as quickly. The most common type of cold wallet is a hardware wallet: a physical device that stores your crypto keys. They are best treated as safe deposit vaults - used to secure undeployed assets.

Other security measures you should consider in a crypto wallet include fraud detection and prevention features, two-factor authentication (2FA), or seed phrase recovery.

The track record of a wallet, including time in the market, or previous security breaches or hacks should also be noted.

2) Corporate Governance: Who Has Access?

Good corporate governance is a matter of accountability for the assets and funds held in your business' crypto wallet.

This includes: (i) who controls your private keys, and (ii) how transactions are approved. Control of private keys is a matter of custody - using third party custodial wallets like crypto wallets on centralized exchanges such as Binance or Coinbase mean that you likely have no real control of your funds.

Businesses are accepting payments in cryptocurrency should choose a safe, self-custodial crypto wallet. This is because a non-custodial wallet gives users sole control of their private keys and thus gives them control over their crypto assets.

One of the key differences between a business bank account, and a self-custodial business crypto wallet is that the funds in the latter cannot be moved or lent out without your permission. There can be no such thing as a bank run your wallet. That is a lesson that we seem to forget and re-learn with each new banking crisis: from the Great Depression to the collapse of Silicon Valley Bank.

But even if you use a self-custodial wallet like Metamask, where only one person has the private keys - it places one person in charge of the entire company's funds.

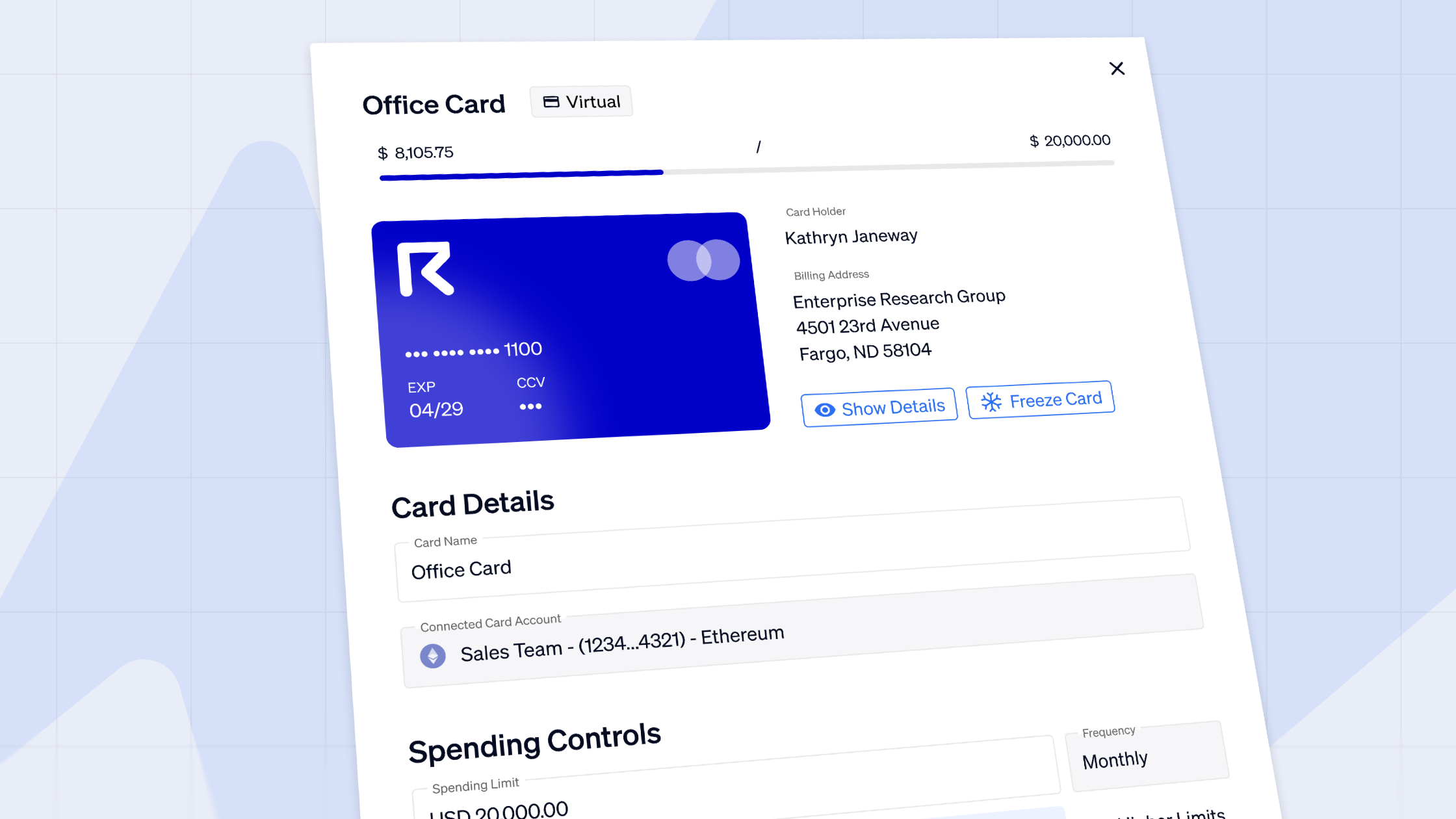

Using an MPC/multi-signature wallet where multiple private keys, or key shards are required, it can give you the ability to implement access control management, spending policies, limits, and permissions.

3) Financial Reporting

Financial reporting covers accounting, tax filing, and compliance with anti-money laundering (AML) reporting requirements. This is perhaps one of the most critical, yet over looked aspects of selecting a business crypto wallet.

Financial reporting is just as important for internal, as well as external stakeholders. Even without the threat of falling afoul of regulatory requirements, businesses need to be able to easily see where their money is coming from, and going to - even in crypto.

However, one of the key challenges - even with many business crypto wallets, is the pseudonymous nature of wallet addresses. Unlike with traditional bank accounts, crypto wallets are not tied to real world identities like business names.

This can make financial reporting challenging, as it is difficult to tag, or otherwise identify transactions for bookkeeping purposes. Using specialized enterprise crypto payments tools like Request Finance can allow you to add some of these functionalities to over hundreds of different crypto business wallets.

Better yet, the accounts payable/receivable data can be easily exported to any legacy accounting software ranging from Xero, to Oracle Netsuite.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Best Non-Custodial Crypto Wallets For Businesses

Safe

Safe is a multi-sig cryptocurrency wallet that securely stores Ether (ETH) and ERC-20 tokens. The wallet is available as both a desktop/mobile application and a browser extension, giving it the capability of providing a more comprehensive range of functionalities to users.

Pros

High-end security features - The wallet offers advanced security features such as a multi-signature vault, two-factor authentication, etc.

DeFi focused - The wallet integrates some of the most popular DApps built on Ethereum and thus makes it possible for businesses to invest, earn, borrow, invoice, do payroll, and more. Request Finance is also listed in safe app directory, which integrates all the DApps.

Top-notch customer support team - The wallet has a highly responsive customer support team that helps businesses with their problems.

Offers a demo - A demo version of the wallet is available, which allows businesses to test the vault and check if it suits their requirements.

Cons

Limited assets supported - The wallet only supports ETH and ERC-20 tokens. As a business, you would want your wallet to support as many assets as possible. This makes it easier for customers to make payments in whatever assets they have available and thus avoids the hassle of converting one asset to another.

Wallet deployment fee - While the wallet is free to download, users will need to pay a fee of 0.005 ETH to create a wallet. However, as a business, if you feel that the wallet offers the features you need, this fee should not be a problem. Safe is a high-quality multi-sig crypto wallet that offers great value-adding features. The team at Request believes that it is one of the best crypto wallets out there and even uses Safe, especially to leverage their Batch Payment feature that enables multiple payments.

Ledger

Ledger is one of the best-selling cryptocurrency hardware wallets, with over 3 million devices sold. It allows users to buy, store, exchange, and grow their crypto assets.

Pros:

Wide variety of crypto assets supported - Ledger supports many different crypto assets such as Bitcoin, ETH and ERC-20 tokens, Litecoin, XRP, TRON, EOS, BCH, Money, VeChain, and many others.

High-quality security features - For businesses, the security of their funds is paramount, and there are not many wallets that offer better security features than Ledger wallets. The device uses robust security features such as adding two layers of protection that have helped the wallet gain a reputation for being secure.

Ease of use - The wallet is easy to set up and easy, making it a beginner-friendly wallet. Businesses that have newly started accepting crypto payments can set up a wallet easily and in less time.

Cons:

Limited number of crypto apps - Due to the limited storage space, Ledger devices such as the Ledger Nano S can only hold up to 6 applications, depending on the size. This limits the use of crypto assets stored in the wallet. To access more apps, users have to buy the higher-end Ledger device, Ledger Nano X that supports 100 applications. Thus, if you’re a business looking to accept crypto payments and make the most of your assets while they are stored in a wallet, it’s vital that you invest in a higher-end Ledger wallet that supports more apps as this will allow you to do more with your crypto assets.

Cannot be shared with multiple users - As a business, you need a wallet that can be accessed by different users to send and receive payments. But, Ledger wallets do not offer this functionality. Hence, Ledger wallets are mostly used for treasury purposes by businesses to store their assets and not as a wallet for daily transactions.

MetaMask

MetaMask is a digital wallet created in 2016 by Aaron Davis and Dan Finlay. It is used by businesses for managing, transferring, and receiving ETH and ERC-20 tokens. It's a cryptocurrency wallet and a web browser extension (for Chrome, Firefox, and Brave) and enables businesses to conduct Ethereum transactions via standard websites.

Pros

Unrivalled access to the DeFi ecosystem - MetaMask provides direct access to tens of thousands of apps for trading, staking, lending, borrowing, derivatives, asset management, and other financial services.

Simple interface - MetaMask is fairly simple to use once set up, as other MetaMask wallet reviews have also stated. All the wallet functions are simply laid out, making sending and receiving cash easy for even businesses newly accepting crypto payments.

Security - MetaMask hasn't been hacked in any significant way. It employs HD backup settings and has a large development community that keeps its open-source code updated.

Support - MetaMask has an active community forum where community members offer support to fellow users.

Cons

Susceptible to phishing attacks - Phishing attempts are the most common threat to the MetaMask wallet. Phishing is a scam in which hackers attempt to get personal information such as usernames and passwords. With online wallets, this type of assault is prevalent. Because businesses are responsible for their own security, it is critical to exercise caution.

Lack of data privacy - While MetaMask does not have access to your or your customers' personal information, the browser you are using does. Most browsers, such as Chrome, acquire information about their users, which may jeopardise a user’s privacy.

Manually listing assets for use - As MetaMask supports ETH and any ETH-based token (ERC20, 721, and more) only, businesses may need to manually list some tokens to see them within MetaMask.

Qredo

Qredo Wallet is designed to provide fast and secure management of digital asset portfolios. It offers institutional-grade secure crypto storage, enabling users to confidently store their assets.It empowers users to control access to their digital assets among trusted parties, teams, or organizations. Qredo leverages the Multi-Party Computation (MPC) architecture which allows the MPC network to handle transaction signing and validation, eliminating the need for individual private keys.

Pros

Decentralized MPC - Qredo uses the MPC architecture which removes the single point of failure of the private key, making theft or loss almost impossible.

Cross-chain interoperability - Qredo enables seamless cross-chain swaps of supported assets within the Qredo ecosystem without any withdrawal fees.

Accessibility - Qredo supports peer to peer transfers where assets can be instantly transferred between custodians, brokers, and financial institutions. When it comes to withdrawals, the process is quick and secure at the speed of biometric authentication.

Cons

User Interface and Experience: Some users may find the user interface of Qredo to be less intuitive or visually appealing compared to other wallet options. That said, user experience may vary based on individual preferences and experiences.

Limited information: Detailed documentation or public resources about the Qredo Protocol may be scarce, which can make it challenging for users to understand its implementation fully.

Fireblocks

Fireblocks is a premier digital asset security platform designed for enterprises, offering a comprehensive suite of services including asset movement, storage, and issuance. By leveraging the Fireblocks Network and MPC-based wallet infrastructure, financial institutions can confidently build, operate, and expand their digital asset operations securely. They’ve facilitated over $150 billion in digital assets, and provide a distinctive insurance policy that covers assets in both storage and during transit.

Pros

Robust security measures - Fireblocks combines MPC-CMP with hardware isolation to create a multi-layer security technology. It divides private keys among multiple parties, making it extremely difficult for hackers to gain unauthorized access as there is no single point of failure.

Support for various cryptocurrencies - Fireblocks offers support for a wide range of cryptocurrencies, enabling businesses to manage diverse portfolios conveniently. By accommodating various digital assets, Fireblocks caters to the evolving needs of businesses operating in the crypto space.

Simple interface - Fireblocks is easy to use with intuitive controls and clear navigation for businesses to execute transactions, monitor balances, and manage their digital assets.

Cons

Counterparty risk - In 2021, Stakehound lost a portion of a sharded key that was stored with Fireblocks due to human error. As a result, they were unable to access the wallet and lost more than $72 million worth of ETH. This incident serves as a reminder that counterparty risk persists even in custody providers that utilize centralized MPC infrastructure, encompassing potential risks ranging from internal employees to MPC cloud providers.

Lack of device compatibility - There’s a lack of industry HSMs that support the MPC technology, making it necessary for MPC solutions to be custom-made and often utilizing closed-source libraries. This lack of standardization and device compatibility adds complexity to the adoption and implementation of MPC technology that Fireblocks uses.

Coinbase Wallet

Coinbase wallet provides users with self-custody capabilities, allowing them to have full control over their digital assets. Unlike centralized exchanges like Coinbase.com, the Coinbase wallet stores the private keys, which are essential for accessing and managing crypto, directly on the user’s mobile device.

Pros

Easy transfer: Coinbase wallet offers a seamless transfer process from Coinbase, which is the largest US based exchange. This integration allows for convenient movement of funds between the exchange and the wallet, providing fast on and off ramps of their assets.

Functionality: Coinbase wallet allows users to buy and store digital assets including all ERC-20 tokens and NFTs without the custody of a centralized exchange.

Enhanced security: By leveraging Secure Enclave to store the private keys of the user, there are user authentication options such as 2FA, Google Authenticator and a Coinbase wallet app that grants access only via a four-digit security PIN.

Cons

No cold storage: Users of hot wallets may be more susceptible to phishing attacks as their private and public keys are connected to the Internet. A user reported to have lost 90% of his life savings from his Coinbase wallet due to a hack.

Limited browser compatibility: Coinbase wallet is only available as a mobile app or browser extension with Google Chrome.

Crypto.com DeFi

Crypto.com DeFi wallet is a non-custodial wallet that offers users a comprehensive range of DeFi services within a single platform. Users can conveniently manage over 100 different coins and various ERC20 tokens.

Pros

Integration with Crypto.com: Crypto.com DeFi wallet integrates with the rest of Crypto.com offerings which allows users to move funds from the wallet to their Crypto.com account for easy fiat on/off-ramps.

Accessibility: Users can conveniently access their Crypto.com DeFi wallets on Chromium-based browsers and mobile apps for both iOS and Android devices, allowing them to engage with various protocols and dApps easily.

Highly secure: Crypto.com DeFi wallet supports biometric and 2FAs to protect access to the wallet if anyone gets hold of the user's phone.

Cons

Additional fees: In the case of interacting with decentralized applications (dApps) through the Cryto.com DeFi Wallet, there are fees associated with such usage. The DeFi Wallet applies a service fee of 0.05% on the earnings generated through its DeFi offerings.

Geo-restrictions: Crypto.com DeFi wallet limits access to certain features or services based on the user's geographical location. For instance, users of a geo-restricted region is unable to swap tokens using DeFi wallet’s native swap page.

Which Wallet Is Best For Your Business?

When it comes to choosing the best wallet for businesses, no one solution suits every business. This is because companies might have different purposes and requirements for using crypto-wallets. However, here is a list of things that you can consider before choosing a wallet for your business:

- Do you plan on only using crypto for payments?

- Do you plan on holding crypto in your corporate treasury?

- Do you want to take responsibility for your funds and private keys or prefer using a trusted third party to manage your funds?

- Will multiple team members use the company’s crypto wallet?

- Are you going to be using your wallet for other business functions like payroll?

Answering the questions above will help you make a more informed decision as to which wallet best fulfils your business requirements.

Moreover, a business can also consider using different wallets for different purposes. This is because using a single wallet is way too risky for businesses that plan to take a hands-on approach towards accepting crypto payments. While most wallets offer great security features, one can never guarantee that a wallet cannot be hacked.

Thus, to manage risks better, businesses should split their crypto holdings across different wallets. Additionally, doing so will help you try different wallets and see which suits you best according to your business requirements.

Wrapping Up

Accepting crypto payments offers many benefits, and as a result, many companies have started integrating crypto into their business models. However, being a relatively new asset class, not all business owners know the best practices when it comes to storing cryptocurrencies in wallets.

Just like with regular bank accounts, and traditional cash registers, your business should avoid having all of your crypto stored in one place. It is always a good practice to have multiple wallets designated for specific purposes. At minimum, your business should have two wallets: one for managing and growing your cash reserves, and one where you send and receive payments.

If you’re interested in accepting crypto payments and need help integrating a crypto wallet, you can consider using Request Finance along with others notable apps that are recommended by finance managers for your business.

Using the features of Request Finance, you can easily integrate your business with all the top crypto wallets and manage payments with ease from a single interface, even if you use multiple wallets. So try it out now and harness the power of cryptocurrencies to expand your business!

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.