Crypto Payroll: A Guide to Paying Remote Teams in Crypto & Stablecoins

Managing remote teams involves payroll challenges. Stablecoins and crypto can be the best solution with several benefits.

The Covid-19 pandemic made it increasingly common for teams to be distributed across the globe. Many teams also switched to a remote-first way of working, and hiring.

The benefits of remote-first organizations are compelling:

- Employers can hire from a wider pool of global talent, and expand their operations rapidly beyond their shores.

- Organizations become more lean as onerous fixed costs like rent and other overheads disappear.

- Employees too have the flexibility to work from anywhere, for companies ordinarily beyond their reach.

The Challenges of Processing Payroll Globally

Managing remote-first teams comes with its own challenges for employers. Some of the most crucial ones involve payroll-related questions like:

- How do you pay employees living in countries where you do not have a bank account, or incorporated entity?

- With fluctuating currency exchange rates, how do you ensure fair and equal compensation across the same roles for employees being paid in different currencies?

- How do you deal with some payment networks depositing salary payments instantaneously, whereas others take days, if not weeks?

Handling global payroll challenges today using fiat currencies often means spending hours on administrative tasks each month. Especially for smaller, agile teams, this time is better spent on growing the business. Stablecoins and crypto can provide a solution to these challenges, but employers need to understand the key considerations and benefits, as well as the potential challenges and solutions, before adopting these payment methods.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

The Benefits of Crypto Payroll for Remote Teams

Global commerce demands global banking. Traditional payment rails today are a patchwork of siloed banking systems. Cross-border remittances involve dealing with multiple currencies, fluctuating exchange rates, complex and costly interbank remittance fees.

For employers managing remote teams, using cryptocurrencies can simplify their payroll operations in three ways.

1. Cost savings

Instead of going through the administrative work of incorporating subsidiaries, and opening bank accounts for employees in each jurisdiction, employers can simply set up a crypto wallet with just a few clicks, at virtually no cost. Even higher-end hardware wallets will only set you back by a one-time purchase of a few hundred dollars.

Cross-border payments via traditional payment networks such as SWIFT are not only complex and slow, but also costly. For companies managing larger teams, these costs quickly add up to a few thousands per month just to pay out salaries.

By using cryptocurrencies, these costs can be reduced significantly, freeing up capital for more important projects. A recent research paper co-authored by Uniswap and Circle estimates that decentralized finance (DeF)i rails could reduce remittance costs by as much as 80%, saving as much as $30 billion per year.

2. Hedge against FX fluctuations

One of the benefits of global teams is being able to employ talent from countries where living and labor costs are significantly lower. But that often means dealing with more volatile currencies.

But despite fluctuations in the exchange rates of local currencies, fair compensation can be accomplished by paying in crypto. For example, employees of the same role could have their compensation denominated in a stablecoin like USDC by Circle.

Employees can then choose to convert a portion of their USDC into a local currency to meet their discretionary spending needs. This does not only ensure equality among roles, but also protects employees from volatility in their local currencies.

3. Instant payouts

Delays in payments being routed through various intermediary banks can also result in confusion, and uncertainty for employees wondering when their pay will come in.

When payments fail to arrive on time, employees and employers must call their respective banks using the MT103 document generated by the SWIFT interbank messaging network, to manually track if the funds are being held up in regional clearing banks on the way. Moreover, an MT103 does not guarantee that the funds will arrive in the designated recipient’s bank account if there are errors in the telegraphic transfer (TT).

Using a common cryptocurrency & blockchain payment rails for compensation also ensures that everyone is paid almost instantly. This also helps to avoid the needless, often tense communication between employees, human resource departments, and their respective banks trying to trace the payment.

According to a study from LexisNexis Risk Solutions, failed payments are estimated to have cost the global economy $118.5 billion in fees, labor and lost business in 2020. Shockingly, the study also revealed that banks, financial institutions, FinTechs and other payment service providers were willing to tolerate failed payment rates of up to 5%.

The Challenges of Crypto Payroll

Yet, despite the benefits, even crypto-native companies still need help to use crypto for their payroll needs.

1. Tedious manual payouts

For starters, paying a large number of employees with crypto, where each payment often needs to be approved separately in multiple steps, can sometimes feel like a marathon. This is tedious and prone to human error, like double payments or paying to the wrong wallet address.

2. Tracking accounts payable and receivable

Worse still, once you’re over the finishing line, you can easily lose track of which accounts payable have been paid, or are still outstanding. Finance teams must manually check payment confirmations from different blockchain explorers, and send the data to their individual beneficiaries.

3. Financial reporting in crypto

Additionally, accounting for crypto transactions is still tricky when there is no way of easily tagging them to your organization’s chart of accounts, or exporting that data into your general accounting ledger.

This also creates difficulties in assessing employers' and their teams' personal and corporate tax liabilities. The taxation of crypto compensation is highly dependent on the jurisdiction an employee or company is located in.

The inability to easily retrieve transaction records in a readable format like bank statements, makes it difficult to prepare tax filings when using cryptocurrencies for compensation.

How Request Finance Simplifies Crypto Payroll for Global Teams

At Request Finance, we are building the all-in one finance solution for companies using crypto. That’s why we recently launched a feature to make it easier for companies to tap into the advantages of cryptocurrency for payroll. Here’s how.

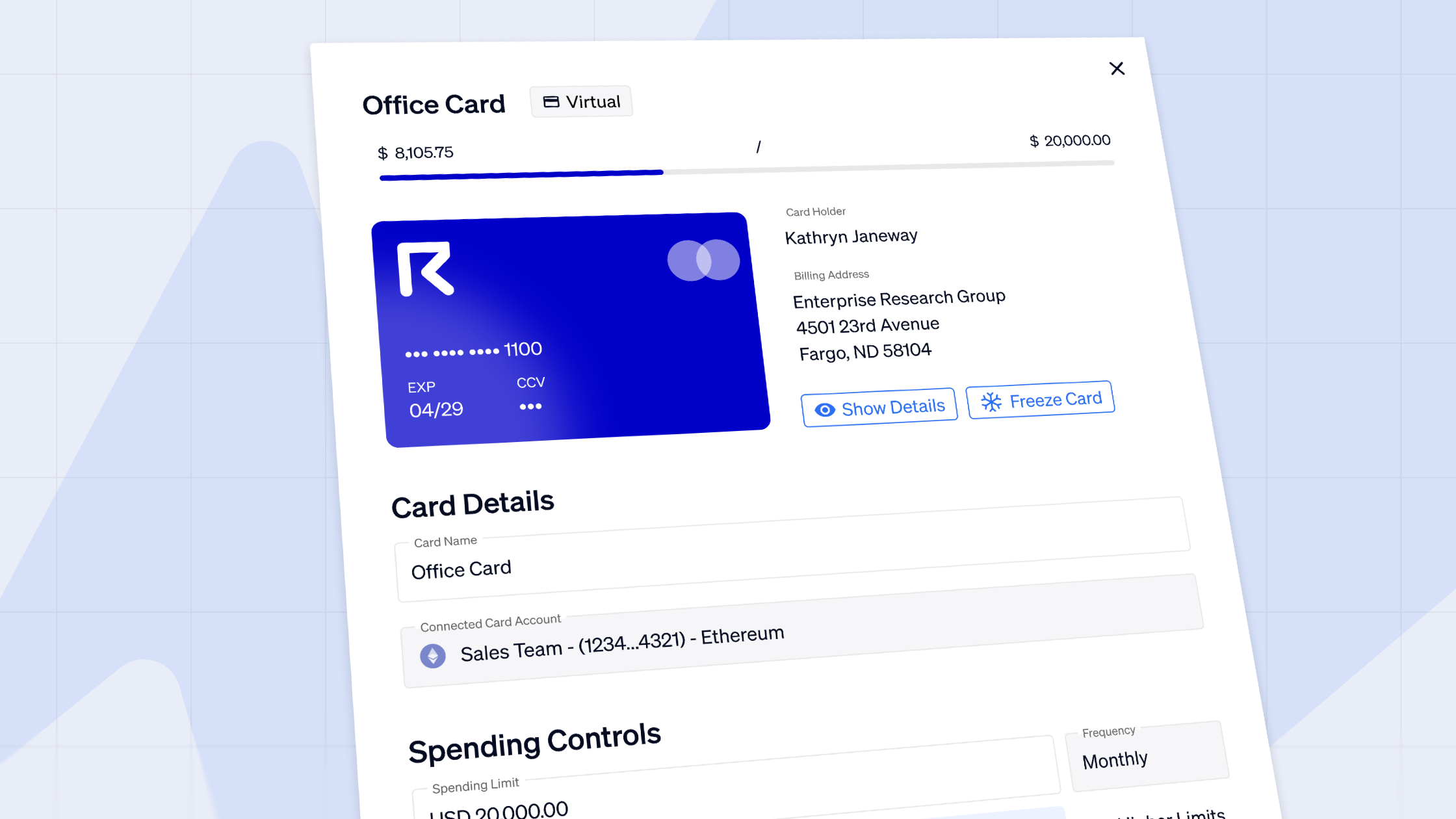

1. Managing employees

Before paying any compensation, you must ensure it goes to the right employee. However, wallet addresses can take a lot of work to remember. Copy-pasting wallet addresses from an Excel spreadsheet into a wallet is also prone to error.

Instead, we let you manage your own contact list of employees in the app by name, job title, department and other data. Managing bigger teams? You can quickly add multiple employees by uploading a CSV file.

Watch below to see how it works

2. Paying salaries or bonuses in crypto

Once your employees are added, you can specify their compensation by creating one-off or recurring payments. Each payment will be shown to you in a dashboard, where you can easily see what needs to be paid, is already paid or even overdue.

You and your employees can even export this data into a spreadsheet, or software like Xero, or Quickbooks for tax and other financial reporting purposes.

Watch below to see how to set up a recurring payment:

Tired of approving salary or bonuses separately for each employee? We allow you to batch approve multiple payments in one go, saving you up to 90% of time.

Watch below to see how to make a batch payment:

We will keep improving the feature to make sure that paying compensation in crypto becomes as easy as possible. What other features would you like to help you simplify and automate your crypto payroll?

Tell us via our Twitter DMs, or the Intercom chat button at the bottom-right corner of the app when you login to Request Finance.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.