How To Reduce Your Global Payroll Costs

Explore ways to reduce your global payroll costs, including leveraging cryptocurrencies, hiring freelancers, and embracing automation.

When we think about running a business, we often focus on driving sales and expanding our customer base. However, for most companies, the largest expense isn't marketing or product development—it's payroll.

According to a study conducted by Deloitte, payroll costs average between 50% to 60% of spending for a typical Fortune 500 company, amounting to $2 billion annually.

Global payroll, which includes salaries, wages, payroll taxes, and employee benefits, also includes administrative costs, processing errors, compliance fines, and international transaction fees. It's a complex area fraught with challenges that can drain resources if not effectively managed.

Let's examine these global payroll challenges and explore practical strategies to help businesses reduce their global payroll costs.

Global payroll challenges

Managing global payroll is no easy task. It's riddled with challenges that require time, resources, and expertise to overcome.

However, understanding these global payroll challenges is the first step towards effectively managing them and minimizing their impact on your organization.

Operating a global business comes with its unique set of payroll challenges, including hidden costs, lengthy processing times, and payroll errors.

Hidden costs of global payments

One of the primary hurdles in global payroll management is the hidden costs often associated with international payments. These costs are often overlooked during the planning stage, only to surface later, causing financial strain on the company.

Bank fees can be a significant drain on resources when managing global payroll. These fees can take various forms, such as transfer fees, service fees, or transaction fees, which can significantly add up over time. Sending money across borders via banks remains the most expensive channel, costing an average of 10.89% in the first quarter of 2020.

Exchange rates add another layer of complexity and cost to global payroll management.

A study by McKinsey & Company on global payments found that businesses face the challenge of currency exchange rate volatility, which can erode profit margins.

When doing business internationally, you'll typically need to pay your overseas employees in their local currency. However, exchange rates fluctuate regularly based on a multitude of factors like economic indicators, geopolitical events, and market sentiment.

This volatility means that the exact amount you need to pay your employees in their local currency can change from one payroll cycle to the next, even if their salary in your home currency remains the same. This can make budgeting difficult and can lead to unforeseen expenses if the exchange rate moves against you.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Long processing time

The traditional way of processing payroll can be time-consuming, particularly when multiple intermediaries such as banks and payment processors are involved.

Each intermediary introduces its own processing time to the overall payment process.

While the majority of cross-border payments reach the beneficiary within one day, the presence of intermediaries such as correspondent banks can extend this time to even up to days.

This slows down the payroll process and can lead to missed payment deadlines and disgruntled employees.

In extreme cases, the sudden collapse of banks will have massive delays in paychecks. Silicon Valley Bank’s (SVB) collapse affected many payroll processing companies which led to thousands of paychecks not reaching employees and businesses.

Such incidents highlight the risks associated with relying solely on traditional banking systems for payroll processing.

Payroll errors

Despite our best efforts, mistakes happen.

For global payrolls, you’ll have to account for multiple variables, including different tax systems, varying pay scales, and currency conversions.

When done manually, this process can be incredibly time-consuming and error-prone, especially when dealing with international payments and multiple currencies. Companies that use manual payroll processing have error rates between 1% and 8%, driving up the cost of payroll.

Incorrect calculations in any of these areas can lead to your employees being paid too little or too much. Either scenario can be problematic—underpayments can lead to employee dissatisfaction and potential legal issues, while overpayments can lead to a drain on company resources.

The regulatory framework for cryptocurrencies can be complex, with different jurisdictions having their unique focus and jurisdiction.

In addition to these federal regulations, some states have introduced specific regulations for cryptocurrency businesses operating within their borders. For instance, the New York BitLicense imposes particular requirements on crypto businesses operating in New York.

This is compounded in a global payroll setting, where you have to navigate the regulations of each country in which you operate.

Once an error has been made, it can be time-consuming and costly to rectify. You'll need to identify the issue, determine its cause, correct it, and then process an additional payment if an underpayment has occurred.

This can lead to increased administrative costs and damage your company's reputation if errors occur regularly.

Ways to reduce global payroll costs

Fortunately, there are ways to mitigate these challenges. Here are some ways that your business can adopt to cut its global payroll costs:

1. Use crypto for payroll payments

One promising approach is to explore the use of cryptocurrency for payroll payments.

Crypto payroll could notably speed up the payment process, reducing transaction times to minutes as opposed to days for bank transfers.

Paying in crypto could also reduce transaction fees significantly, depending on the transfer amount and any currency exchange costs. Let’s take a look at the hypothetical comparison below:

Moreover, cryptocurrencies like stablecoins provide businesses with flexibility, allowing them to switch their treasury holdings to different currencies. Decentralized finance (DeFi) platforms offer options that enable even small businesses to hedge against foreign exchange risks.

Using crypto payroll can simplify payroll processes, reduce hidden costs, and ensure that unexpected situations, like the SVB collapse, have minimal impact on business continuity.

2. Hire freelancers and contractors

Hiring international freelancers and contractors can be a cost-effective alternative to full-time employees.

Full-time employees come with associated costs such as health insurance, retirement benefits, vacation and sick leave, and other benefits. Freelancers and contractors, on the other hand, manage their taxes and typically do not receive these benefits.

Nearly half of the companies surveyed in a 2021 Deloitte study, stated that their decision to employ freelancers was driven by the desire to decrease labor expenses.

As a result, companies can save a substantial amount by opting for contracted work. However, it is crucial to ensure the proper classification of contractors to mitigate the risk of misclassification.

For Web3 businesses, it’s known that the industry is rapid and ever-changing demands. Hiring freelancers provides the flexibility to scale your team quickly in response to business needs.

By hiring freelancers, your business can tap into a global talent pool to find professionals with the precise skill sets you need. This is especially beneficial for Web3 businesses, as the global Web3 industry faces talent shortages.

According to Linkedin, there has been a 76% annual increase in the Web3 industry, but nations that typically produce the most professionals in the Web3 space are seeing a decrease in talent expansion.

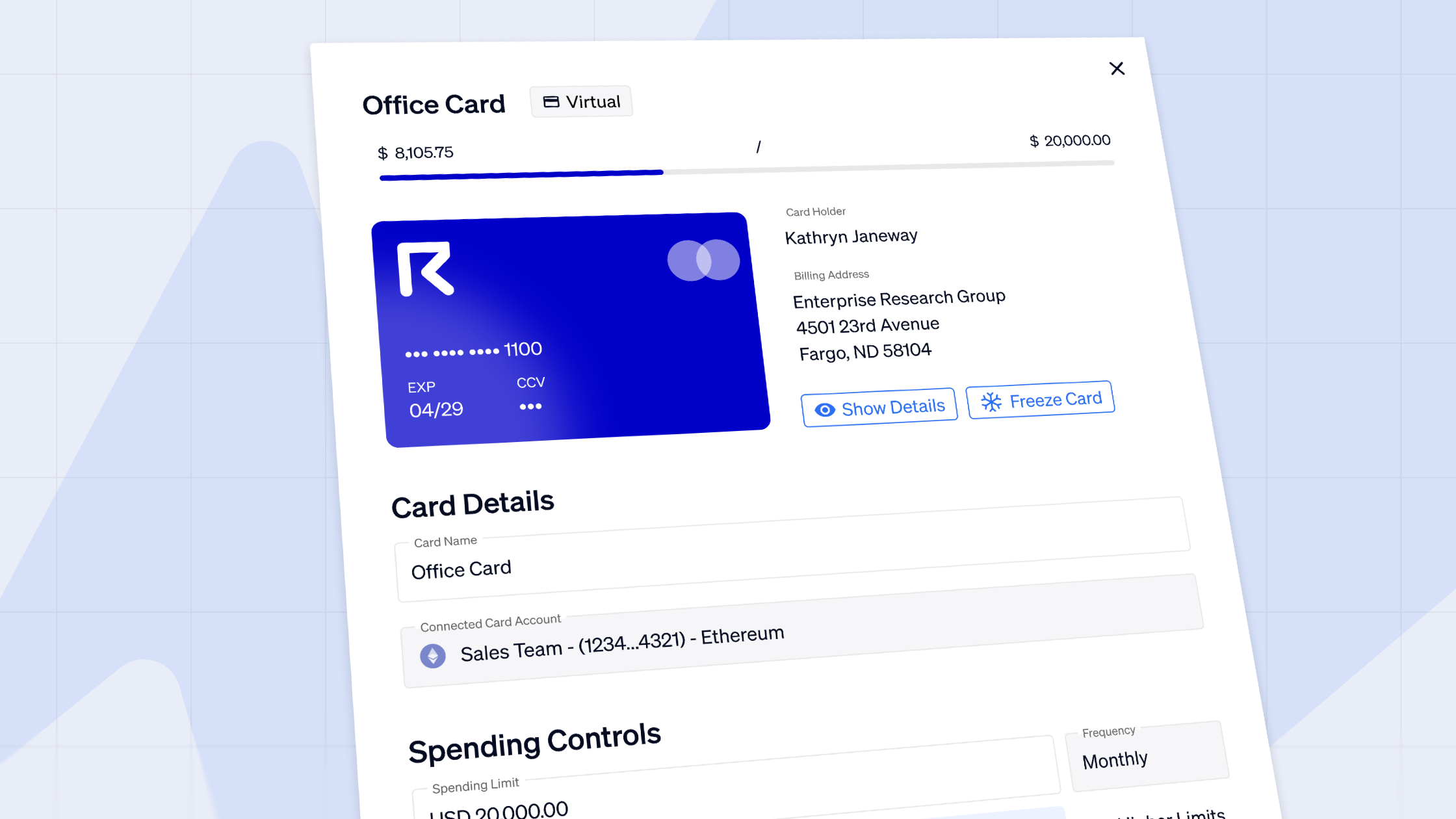

With Request Finance for payroll, you can easily pay all your freelancers at once. You can also set up recurring payments, and track real-time and currency conversions automatically in a single dashboard. This way, it’s easy to pay freelancers and contractors in crypto timely and accurately.

3. Use Request Finance for payroll automation

Payroll automation can streamline processes, reduce manual intervention, and lower payroll costs. By integrating payroll software with other systems and leveraging automation tools, businesses can achieve faster processing times, minimize errors, and decrease administrative costs.

Your business can save up to 80% in payroll processing costs by embracing payroll automation.

Processing cryptocurrency-based salaries can be complex and susceptible to mistakes. By automating payroll with Request Finance, you can streamline numerous workflow steps in paying your team using cryptocurrencies.

Not only that, having proper payroll software aids your organisation in fulfilling its financial reporting requirements such as accounting, audit, taxation, and Anti-Money Laundering (AML) obligations involving crypto.

Building a future-proof payroll strategy

Businesses that recognize the importance of having effective payroll operations are more likely to succeed in the increasingly globalized and complex business environment.

Managing global payroll can be daunting, but by understanding its global payroll challenges and implementing the right strategies, businesses can significantly reduce their payroll costs and foster a healthier bottom line.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.