Liquidity Management: Challenges and Solutions for Web3 CFOs

Master the nuances of liquidity management in the crypto landscape. Our in-depth guide helps Web3 CFOs tackle currency risks, understand tenor, and avoid slippage to ensure financial stability.

Managing an organization's finances is akin to ensuring a well-oiled machine.

A Web3 CFO plays a pivotal role in this, particularly in maintaining an effective chart of accounts and developing a robust budget. These tasks are critical for ensuring liquidity and solvency, especially in the volatile landscape of crypto markets.

This article aims to dissect the key challenges that Web3 CFOs face in liquidity management, particularly in the volatile crypto market, and offers actionable insights for developing a budget strategy.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Understanding liquidity management

Solvency and liquidity are not interchangeable terms. A high net asset value for your treasury on paper doesn't guarantee that you can meet your financial obligations as they arise.

Solvency is about whether the value of the assets you own, equals or exceeds the liabilities you owe. Liquidity is whether or not you have the cash (or equivalents) available to pay your dues to employees, suppliers, lenders, and shareholders.

Focusing on asset values instead of liquidity can lead to overlooking three key challenges that can result in cash flow issues:

1. Currency

Web3 teams are often remote-first and globally distributed, making them susceptible to foreign exchange risks from day one.

Crypto treasuries are unique in their composition. They often hold a diverse range of assets, including but not limited to blue-chip NFTs, governance tokens, altcoins, and even Bitcoin. These assets are not universally accepted forms of payment, adding an extra layer of complexity.

On the flip side, their liabilities are often denominated in stable fiat currencies like the USD. In some cases, they may even have to deal with salaries or incur other expenses in local currencies that have fluctuating exchange rates against the USD.

This mismatch between assets and liabilities can lead to significant financial turbulence. For instance, if your treasury holds assets in Ethereum (ETH) and you have liabilities in USDC, a sudden downward price correction in ETH can make those USDC liabilities far more expensive than initially planned.

It’s a reality that many DAOs and crypto companies face. According to the Chainalysis State of Web3 Report, the average DAO with assets over $1 million experienced a maximum drawdown of 51% in 2021, compared to Bitcoin's 72%.

2. Tenor

Tenor, also known as maturity, signifies the remaining duration before a financial contract—such as derivatives or loans—reaches its expiration or is fully paid off. Assets in your treasury might be tied up in various lending agreements or financial positions that are not easily liquidatable without incurring significant losses on their market value.

This discussion doesn't even touch upon the added complexities of counterparty and smart contract risks, which could lead to defaults. Events like the downfall of Terra and the subsequent banking collapses, such as that of Silicon Valley Bank, serve as cautionary tales in this context.

When combined, these factors suggest that the actual utility of your treasury's assets in fulfilling financial obligations might be less than anticipated.

Your assets may be tied up in long-term contracts or financial instruments that cannot be easily liquidated without taking a significant loss. This is particularly relevant in the crypto, where assets may be deployed in various lending contracts or DeFi platforms.

3. Slippage

The majority of today's crypto assets don't qualify as cash or cash equivalents under established accounting standards like IFRS or GAAP.

This issue was thoroughly examined by Hasu and colleagues in their 2021 article, "A New Mental Model for Defi Treasuries." They argue that governance tokens, for instance, should not even be counted as part of a DAO's treasury assets—a viewpoint that may be evolving due to recent advancements in DAO management tools.

While this perspective may seem overly cautious, the underlying concerns are valid. Apart from specific cases like ecosystem grants or investor rewards, the bulk of an organization's expenditures typically cannot be covered using highly volatile tokens or equity stakes.

Best practices to create a budget strategy

To avoid overspending, Web3 CFOs use budgeting to maintain liquidity. But the benefits extend beyond cash flow. Budgeting aids in strategic decision-making and enhances organizational transparency.

You should develop two types of budgets as a Web3 CFO:

- Capital budget: Tracks long-term investments into strategic projects, or large purchases of assets that are anticipated to pay back over time.

We won't delve into capital budgeting here for a couple of reasons.

Firstly, in traditional companies, capital expenditures typically relate to physical assets like plant, property and equipment (PPE). Very few companies in tech or software have these types of assets on their balance sheet, with perhaps the exception of cryptocurrency mining companies on Proof-of-Work (PoW) blockchains.

Secondly, there are voluminous tomes already devoted to explaining various capital budgeting processes and analytical frameworks like discounted cashflow (DCF) or internal rate of return (IRR). These have long-since evolved into general frameworks that are commonly applied to various investment decisions beyond PPE expenditures.

You can easily use these capital budgeting frameworks to help project managers, or other management think more rigorously about justifying the financial returns of anything from investor relations, running a marketing campaign, deciding on which crypto events to sponsor, or whether to invest in a DeFi options vault versus holding ETH.

- Operating budget: Tracks operating expenses incurred in the ordinary course of the organization’s activities.

When crafting an operating budget, there are three primary objectives to consider:

(i) Identify key revenue drivers and cost centres

The first goal of an operating budget is a qualitative measurement. It helps you to identify your key drivers of revenue, and what are the main cost centres. Armed with this information, you can help to inform critical decisions around spending or product development. Finding financial data is challenging in a crypto setting because of its complexity.

Most crypto companies today generate revenue via platform fees, or smart contract dapps. Alternatively, they may also be deploying their assets to earn yield on various DeFi platforms. Tracking these revenue sources is best done via the help of blockchain analytics platforms like Dune Analytics, or the growing number of crypto accounting software apps specialized to this task.

For example, Messari has been commissioned by various companies to build financial dashboards in Dune Analytics to track the revenues generated by platforms like Compound, Uniswap, and Lido Finance.

However, it should be noted that platforms like Dune are really blockchain data visualization platforms, and are not purpose-built to help Web3 CFOs prepare financial statements.

Especially for organizations that need to track their revenue from a variety of on-chain sources like DEXs, and lending platforms, and label and report them in an accounting-friendly manner, platforms like Cryptoworth are more appropriate.

Cryptoworth streamlines the tracking and reporting of complex on-chain transactions, like DeFi, NFT trades, and liquid staking, making it the go-to platform for efficient crypto accounting management.

(ii) Quantify cashflows

The second goal is more quantitative in nature. An operating budget will help to establish what your organization’s monthly “net burn” is, expenses net of revenue sources. In most cases, this net burn will be a negative number. More cash is flowing out than coming in each month. This liquidity shortfall typically has to be met by drawing down on an organization’s savings, or reserves.

From here, you can forecast what your organization’s runway is before your monthly expenses burn through your fuel reserves.

However, tracking expenses can be a lot more tricky for most Web3 companies. Unlike revenues generated in a largely automated manner from smart contracts, most expenses like payroll, and invoices from service providers - are processed manually.

Additionally, companies in the crypto space that have revenue models closer to traditional SaaS, or simply accept payments for goods and services in crypto may also find it challenging to use either platforms like Dune Analytics.

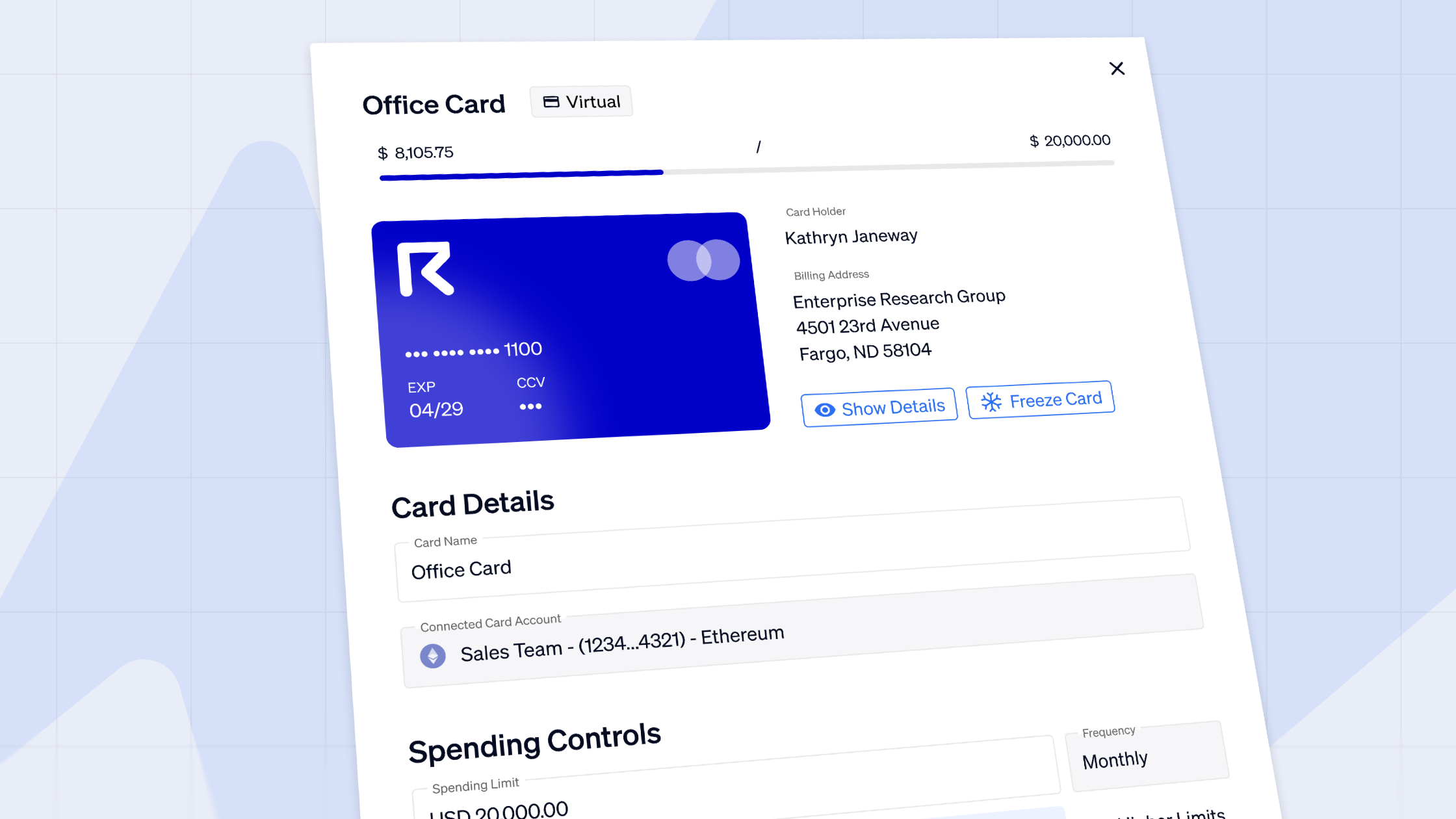

Web3 companies can better track their manual billing operations, as well as spend management by using crypto payments apps like Request Finance can help you consolidate all your crypto cash flows - particularly for payouts - in a single dashboard.

Designed to be an on-chain analogue to billing and spend management fintech apps in traditional finance, apps like Request Finance provide a familiar interface to Web3 CFOs and finance teams.

Crypto payments data like invoices, payroll, or expenses can be categorized into different spend categories, and can be easily exported to any bookkeeping software like Xero.

(iii) Check for asset-liability mismatches

The third goal is equally critical. When calculating your runway, bear in mind the three pitfalls that can affect liquidity: volatility, tenor, and slippage. This is especially relevant if your treasury assets are composed of thinly-traded, highly volatile tokens. Or if you have substantial positions that you cannot close out on DeFi platforms without taking a loss.

To more accurately monitor your organization’s liquidity, you can also monitor traditional measures of liquidity commonly used in TradFi, like the cash ratio.

The cash ratio is a more conservative measure of liquidity that calculates an organization’s runway (in years) - assuming you can only pay your bills with the cash, or fiat-backed stablecoins in your crypto treasury.

It is also important to note that not all stablecoins are equally liquid, or redeemable for cash. That is why most stablecoins are not considered cash equivalents under International Accounting Standard (IAS) 7 laid out in the International Financial Reporting Standards (IFRS).

With that said, what truly matters is your ability to meet liabilities. The type of stablecoin in your treasury becomes relevant only if it aligns with your payment obligations. For example, MakerDAO pays its contributors in DAI, making its large DAI reserves in their treasury (which are less cash-like than say USDC from an accounting perspective), may not matter so much to MakerDAO’s liquidity.

Concluding thoughts

By adopting these practices and understanding the challenges, Web3 CFOs can navigate the complex financial landscape of DeFi, ensuring both short-term liquidity and long-term organizational viability.

You need to choose the right tools and strategies that are indispensable for a crypto company, helping to uncover hidden financial intricacies and ensuring compliance with evolving financial standards.

There are free resources to help manage your organization’s finances effectively, filled with actionable insights, case studies, and best practices tailored for anyone responsible for FinOps, to manage their crypto treasury in the bear market.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.