Managing Financial Operations in Crypto

From invoicing to payment, accounting, and auditing, the partnership between Request Finance, Gnosis Safe, and Cryptio provides a suite of integrated software tools that dramatically simplifies the end-to-end workflows of using crypto for businesses.

Money is to businesses what blood is to our bodies: it sustains critical functions that keep the organization alive and well. Similarly, the cash flows in and out of the company are just as important as a vital measure of financial health, as blood circulation is to our bodies.

But unlike modern medical wearables, the tools that exist today for tracking and managing such financial operations are complex to use, costly to maintain, and antiquated. As businesses are increasingly born global, they must deal with the challenge of integrating and accounting for new payment methods every day - from new payment gateways to increasingly, crypto payments.

The Painful Problem with Payments Today

Today, large companies spend millions on an army of financial operations staff just to keep track of their financial health in real time. Hundreds of these dedicated finance operations staff are tasked with ensuring that the company pays what it owes under its accounts payables, and collects its dues under its accounts receivables. On top of that they must also record and reconcile these payments in the company’s accounting software, or ERP systems. Other divisions are assigned to managing the company’s cash float.

The complexity of arcane financial systems means that breakdowns in financial operations occur with alarming regularity, even at some of the world’s largest corporate giants. Citigroup is in the midst of a multi-year effort to update its underlying controls and technology after U.S. regulators slapped it with a $400-million fine for deficiencies in both areas. Famously, Citigroup’s outdated systems also led to the accidental, and irreversible, payout of nearly a billion dollars to various hedge funds in August last year.

These existing difficulties of managing financial operations in fiat are compounded by the growing acceptance of cryptocurrencies as a payment method. This nascent asset class adds a new dimension of challenges but also of potential upside for companies’ cash reserves, that are driving more companies to desperately seek tools for managing such asset class.

Companies, especially those dealing with crypto payments, need better software tools to manage their financial operations workflows. That is why Request Finance has partnered with Gnosis Safe and Cryptio to provide businesses with an end-to-end crypto accounting suite to streamline, automate, and optimize payments and bookkeeping with cryptocurrencies.

The Complexities of Crypto Payments

Managing accounts payable and receivable in different crypto tokens, and to multiple wallet addresses across blockchains which may not be interoperable, is slow, laborious, and error- prone. Copying and pasting wallet addresses from PDFs and Excel sheets is almost guaranteed to result in the occasional accidental payment to the wrong address. Pay-ins are no better, as counterparties may request to pay in a token that is yet to be supported.

On top of the challenges of managing payments, manual reconciliations are also an administrative nightmare. Financial operations staff must endure the lengthy and tedious effort to meticulously detail payouts and pay-ins, and reconcile counterparties’ data like wallet addresses from an Excel sheet.

New Tools for the Crypto CFOs

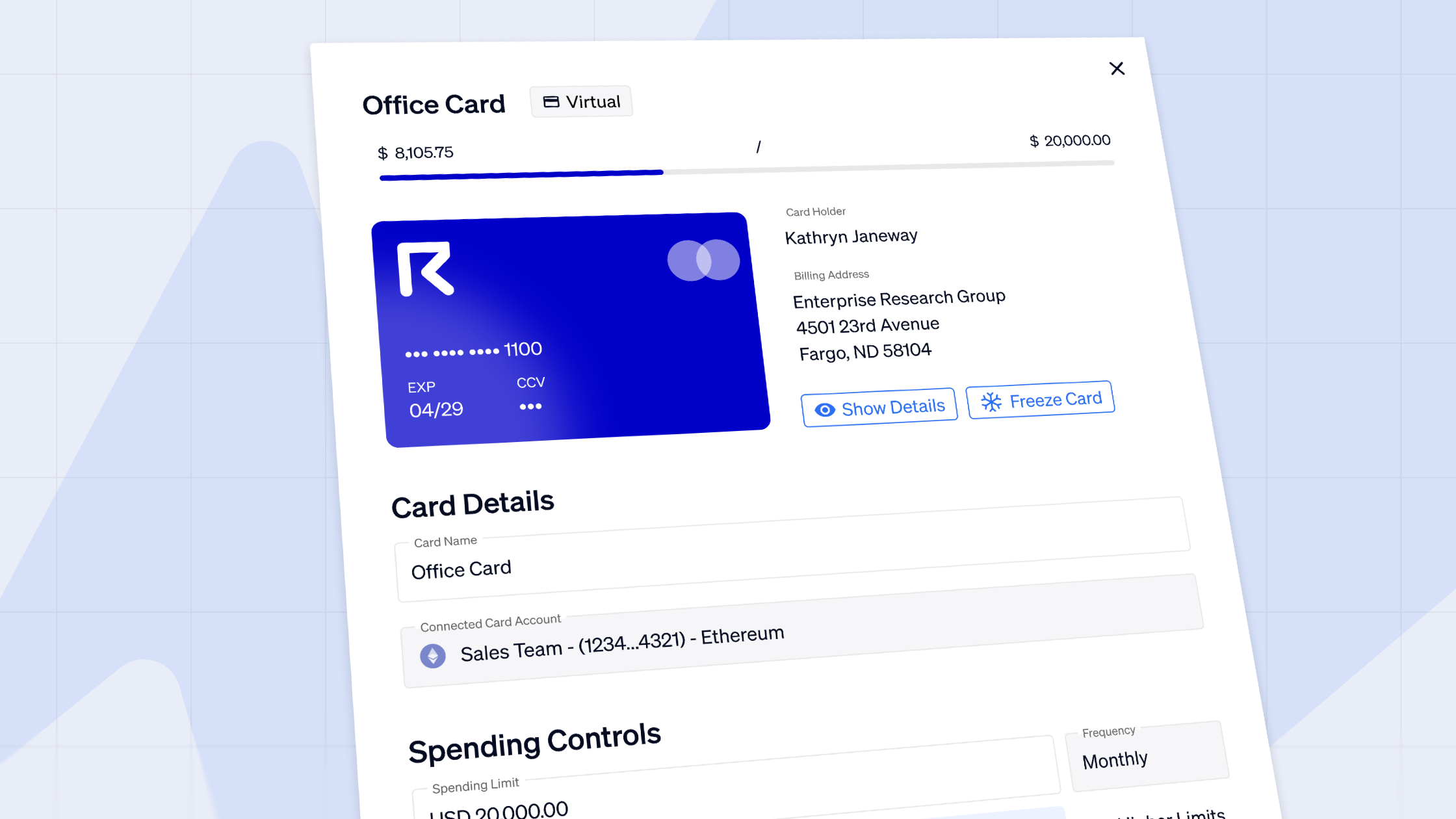

“Request Finance offers an easier and less error-prone way to manage crypto payments in different tokens. It allows counterparties to send invoices pre-filled with the correct payment information linked to their email accounts. This helps crypto finance professionals prevent administrative errors, and save time from not having to retrieve and key in the right payment details.” - Christophe Fonteneau, Head of Partnerships and Business Development at Request.

It also greatly simplifies cashflow management by allowing counterparties, and financial operations teams to easily monitor the status of invoices issued or received, and to verify that a payment was made, all within the web app.

“Request has proven to simplify how we handle crypto-based payrolls”, says Ulysse Ramage, Co-Founder at DeFi protocol, APWine. “The best features for us are the “Invoice Me” payment request feature, and automatic recurring invoices for things like monthly salary payouts”, Ramage explains.

The ability to accept a wide variety of tokens and stablecoins is also another reason CFOs at large crypto-native organizations have turned to Request Finance. With support for a growing list of over 43 different cryptocurrencies and stablecoins across ten different blockchains and nine different fiat currencies, fears of not being able to accept a supported payment method are low.

Moreover, payments are settled in cryptocurrency, but invoices can be denominated in fiat currencies like USD, or EUR, using Chainlink’s price oracles to determine the exact exchange rate at the moment of payment. This simplifies historical accounting, especially for cryptocurrencies that are more volatile in price.

To give companies the ability to automate their crypto payouts at scale, Request partnered with Gnosis Safe.

"Gnosis Safe and Request offers a secured and seamless experience to crypto-first companies for managing their invoices, expenses, salaries and supplier payments. Gnosis Safe’s smart contracts provide Request’s users with added benefits such as batching payments in one click", said John Ennis, Ecosystem Lead at Gnosis Safe.

The ability to make batch payments through a Gnosis Safe wallet allows finance operations teams to select, and pay invoices en masse in just one click. This ensures that accounts payables are settled promptly, and without error.

“The ability to make batch payments meant we could effortlessly manage, and pay invoices”, says Frederic Meyer-Scharenberg, Technology Hub Manager at Trust Square AG, organizer of the Swiss Blockchain Hackathon 2021. “As the hackathon organizers, using Request is an easier and less error-prone way to manage crypto payments in different tokens”, he explained.

With the added benefit of being able to save on transaction costs like gas fees, it is no surprise that batch payments are one of the most frequently used features for companies using Request Finance.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Furthermore, Gnosis Safe’s multi-signature authentication allows financial operations teams to introduce multiple layers of security and checks, before high-value transactions are made. This serves to prevent both human error, as well as detecting attempts at fraud.

In addition to automating crypto payment workflows, Request has also partnered with Cryptio to simplify accounting for digital assets. The integration between Request and Cryptio allows companies to easily push transaction records like invoices and payroll into traditional accounting software like Xero, Quickbooks or Intuit. This also allows auditors and accountants to easily inspect and retrieve the correct invoices associated with each transaction.

From invoicing to payment, accounting, and auditing, the partnership between Request Finance, Gnosis Safe, and Cryptio provides a suite of integrated software tools that dramatically simplifies the end-to-end workflows of using crypto for businesses.

Building for the Future of Financial Operations

As blockchain technologies and digital assets continue to gain ground in international finance, there is a growing need for entrepreneurs to build new software tools for financial operations of the future. These next generation of financial operations tools will do more than just managing payments and bookkeeping. They can also transform financial operations from a cost center, to a revenue driver for organizations. CFOs in crypto-native organizations will someday have easy access to embedded financial services like invoice factoring, credit scoring with decentralized identity, smart contract-based escrow, and treasury management.

It's time players in this emerging space collaborate to build a new payments infrastructure — one that delivers real-time insights, automates manual workflows, and empowers organizations to manage their cash flows in new and valuable ways.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.