The Dos and Don'ts of Accepting Crypto Payments as a Freelancer

Here are some pitfalls to avoid and best practices to emulate for those looking to get paid in crypto as freelancers.

It is difficult to overstate the potential for crypto to revolutionize the way we work and earn money. Successive bull runs in crypto saw the first, large-scale introduction of remote-first teams. Rather than hiring locally, they were hiring globally. Much of this shift is thanks to the ability for anyone, anywhere in the world being able to get paid in crypto.

However, as with any new and rapidly evolving industry, there are also pitfalls to avoid and best practices to emulate for those looking to get paid in crypto as freelancers.

Here’s a list of three dos, and three don’ts for freelancers to consider when being paid in crypto.

DON’T:

1. Keep all your money in custodial wallets

2022 was notable in crypto history for the collapsing dominoes of centralized finance lending platforms and crypto exchanges. From the implosion of UST’s Anchor Protocol, to Celsius and FTX - each time a popular centralized crypto platform fell, they took with them the crypto earnings of thousands of users.

One of the most important things to keep in mind is the issue of private key ownership. As a freelancer, it is crucial that you are in full control of your own private keys and that you do not entrust them to any third party. This includes using centralized exchanges or CeFi platforms, as these can be vulnerable to hacking or mismanagement.

2. Get paid only in one type of crypto

As DAO contributors, or freelancers for nascent project teams, it is common for many freelancers to be offered compensation in the form of a project’s own token. In some cases this may be governance tokens of a protocol, or a stablecoin with close ties to the protocol’s core team.

The temptation of accepting compensation in highly volatile tokens of native projects is clear. When they launch to the public, and grow - the potential for rapid price appreciation can be too good to pass up. Perhaps the most obvious example in recent history of why that might be a bad idea is the collapse of Terra, Luna and the UST ecosystem.

3. Evade taxes and other reporting requirements

The libertarian ethos that undergirds the philosophical underpinnings of crypto and Web3, combined with regulatory uncertainty about the asset class’ legal status in many jurisdictions make it incredibly easy for freelancers to use crypto as a way to mitigate their tax burdens.

While this may be a legitimate tax avoidance strategy in some places - most crypto assets are likely to be subject to income taxes. Even influencers that receive gifts from sponsors must declare them as a form of taxable income in most countries.

In many countries, crypto assets are considered taxable income and must be reported to the relevant authorities. However, some freelancers may be tempted to evade taxes by not reporting their crypto income. This is not only illegal, but it can also lead to significant fines and penalties.

For instance, starting from 2024, any U.S. "person" (including an individual, corporation, partnership, association, trust or estate), in a trade or business who receives more than $10,000 in cash - or crypto - in a single transaction, or series of related transactions must file a Form 8300 within 15 days. Failure to do so may result in civil and criminal penalities.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

DO:

1. Practice self-custody

While centralized platforms and exchanges can be useful for convenient on/off ramps between fiat and crypto, they should not be entrusted to hold most, and certainly not all of your hard-earned crypto from your freelance gigs. Instead, consider using a hardware wallet or a decentralized exchange to store and manage most of your crypto assets.

The collapse of centralized financial institutions is a pattern that predates crypto, and will outlast 2022. In fact, as recent news reports have indicated, the founders of the collapse crypto hedge fund, Three Arrows Capital are already seeking funding to build the next FTX.

Freelancers who get into the habit of practicing self-custody of their crypto assets will be better positioned to avoid the next rugpull, or implosion of a centralized service provider.

2. Diversify your crypto holdings

Another major concern for freelancers getting paid in crypto is the volatility of the market. The value of cryptocurrencies can fluctuate dramatically in a short period of time, and this can make it difficult to budget and plan for your income. To mitigate this risk, consider hedging against price movements by holding a diverse portfolio of assets or using a stablecoin. However, it is also important to be aware of the risks associated with stablecoins, such as the potential for depegging or governance issues.

Freelancers should take care to diversify their token holdings, to hedge against the sharp price movements that are all too common in crypto. Even supposedly “stable” coins - can and have faced serious deviations from their intended pegged exchange rates.

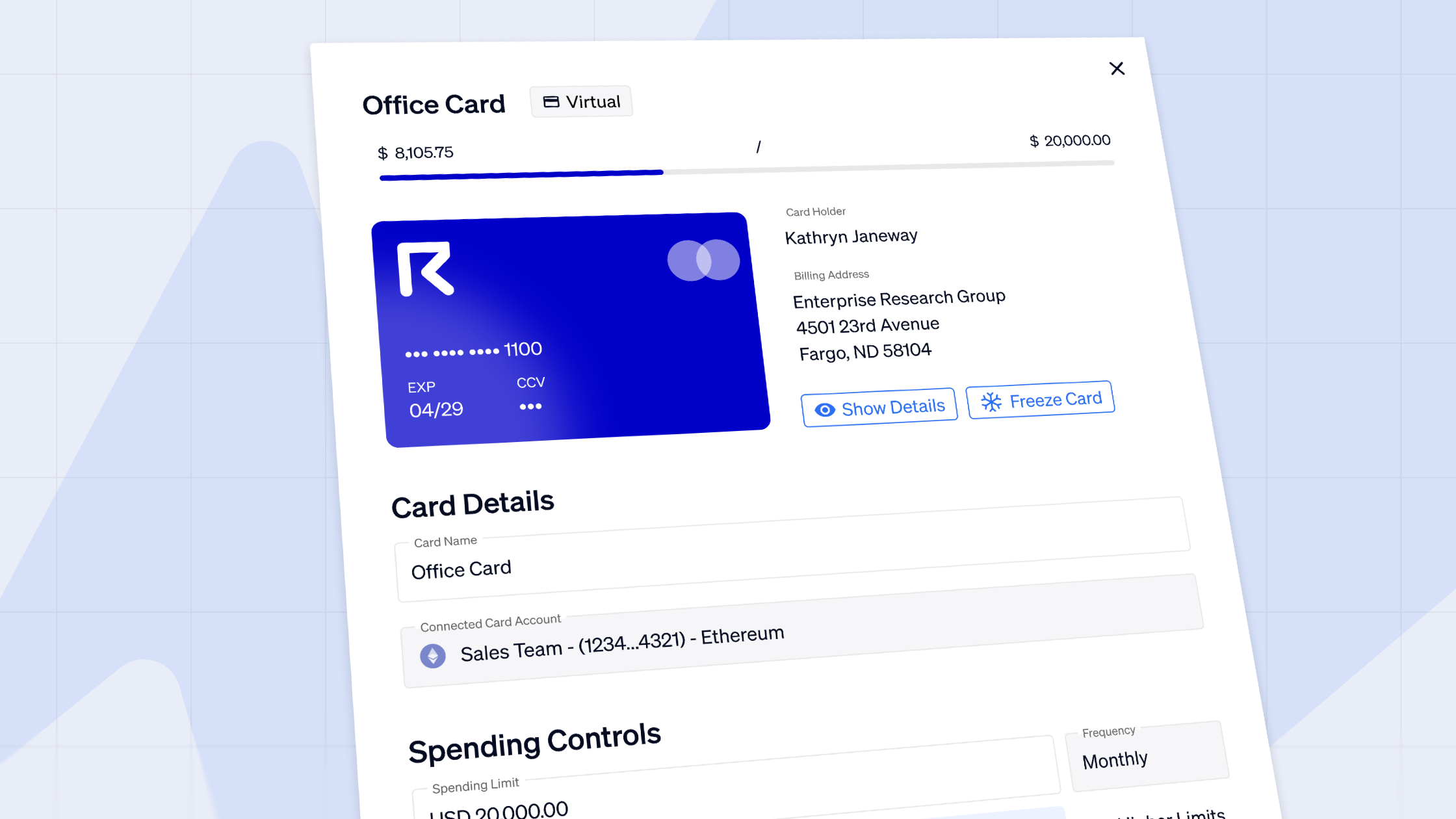

3. Use a professional invoicing tool

Finally, it is essential to be aware of the tax implications of getting paid in crypto. To avoid these risks, it is important to keep proper documentation of your earnings in crypto. For instance, with Request Finance, you can send professional-looking crypto invoices to your clients, allowing them to easily pay you in over a hundred different tokens and chains. You can view and even export all the related transaction data in an easy, human readable format.

This data can also be easily fed into tax and other reporting software, to help you stay on the right side of the law should the authorities ever come knocking.

Freelancers should also consult with a tax professional and stay informed about the tax laws in your jurisdiction. Nobody likes taxes, and least of all Web3 natives that tend to have an aversion towards centralized institutions like the state. But taxes are the subscription fees that finance the provision of public goods.

In conclusion, while the use of crypto in freelance work has the potential to bring many benefits, it is important to be aware of the risks and to take steps to mitigate them. By following best practices such as private key ownership, hedging against price movements, and staying informed about tax laws, freelancers can ensure that they can take advantage of the opportunities offered by crypto while avoiding the pitfalls.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.