The Ultimate Guide To Token Vesting Platforms (2024)

Web2 cap table management software like Carta simply digitize physical documentation and legal paperwork. But Web3 token vesting platforms allow teams to implement more complex token vesting and compensation plans. We review and compare some of the top token vesting and cap table management software in 2024.

The Ultimate Guide To Token Vesting Platforms & Software (in 2024)

As the Web3 industry continues to grow, the need for HR professionals who understand how to compensate employees in this new economy is also growing.

Tokens are playing an increasingly important role in payroll and compensation. Consequently, there are a variety of token vesting software applications available to help companies manage their token-based compensation programs.

In this article, we’ll explain:

- An overview of the different token vesting platforms applications available

- The role that tokens can play in payroll and compensation

- The importance of token vesting software solutions

- Key criteria for evaluating various token vesting platform

An overview of token vesting platforms applications

Tokens serve to complement or replace equity share option plans for many web3-native teams. However, in contrast to traditional equity in private startups, blockchain tokens have unique features like programmability.

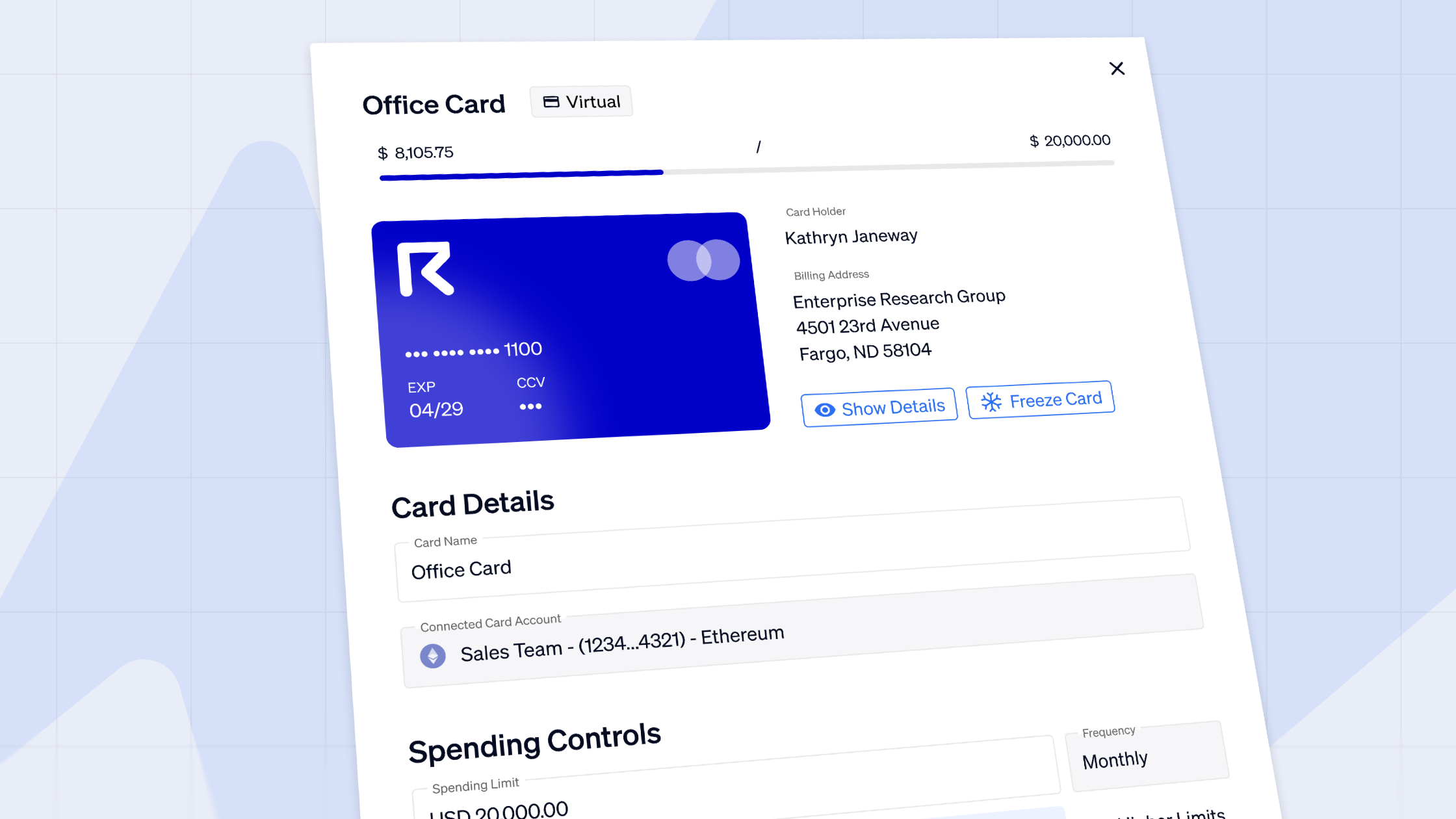

Similarly, the software used to manage token vesting for Web3 teams are also more like payment or banking-like applications than Web2-based traditional equity management software like Carta.

Web2 cap table management software like Carta simply digitize physical documentation and legal paperwork. But Web3 token vesting platforms goes further.

Many of them allow teams to implement real time transfers of tokens via payment streams, program complex vesting schedules, and monitor trading activity by large token holders.

There are different types of token vesting software applications available in the market, depending on the needs and preferences of Web3 companies.

We’ve compiled a list of the various token vesting software applications to help Web3 teams understand their options by the different key features.

Note: The data presented in this infographic is drawn from information available through the companies' public statements and published materials. There may be discrepancies with the actual service offerings to date, and you should always seek clarification with the highlighted companies. For editorial changes, please contact: ludovic.gilbert@request.finance

.png)

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

The role of tokens in payroll and compensation

Tokens are digital assets that represent some form of value or utility within a decentralized network or protocol.

They can be used for various purposes, such as governance, rewards, payments, access, or ownership.

Stablecoins are cryptocurrency tokens that are blockchain-based representations of fiat currencies deposited with the issuer. Using stablecoins for payroll is rather straightforward - and not very different from their fiat counterparts.

Utility tokens are like the newly-minted currency of a newly-independent state. Ideally, as this nascent economy grows and demand for its currency rises, the purchasing power of its pioneering citizenry should also grow.

Paying the early contributors to this new country in its own currency serves to align the interests of the team to the long term growth of the economy.

Thus, for DAOs and Web3 teams, tokens can either compliment - or serve as an alternative to equity stock option plans (ESOPs). Research from Lauren Stephanian and Cooper Turley indicates that the typical token allocation to founders and employees is 17.5%, distributed between 20–40 people.

Token vesting schedule and cliffs/lockups

Token vesting is a mechanism that allows Web3 companies to distribute tokens to their employees and other service providers over time, subject to certain conditions or milestones.

Similar to ESOPs, token compensation plans typically have vesting schedules, with cliffs/lockups. They limit how much, and when employees and founders can sell their tokens.

Shorter token vesting schedules are more attractive to employees, but they can be a risk indicator that deters community members and external investors from purchasing the token.

Founders or core team members who assign themselves very short vesting periods to sell their tokens early, may also devalue the compensation package offered to employees.

Longer token vesting schedules help to incentivize the interests of insiders to ensure that the token price sees sustained growth over the long run. But this also delays their ability to cash in on the value they have created.

The pros and cons of token-based compensation

Token-based compensation packages can offer significant advantages over traditional equity compensation, such as:

- Instant liquidity: no need to wait for a company to exit via an acquisition or IPO

- No exercise price or windows like with stock options

- Compensation is pegged to the market value in real-time (as compared to a startup’s equity value, based on the last fundraising round)

However, token-based compensation also poses unique challenges and risks for Web3 teams, including:

- Regulatory uncertainty over securities status in different jurisdictions

- Tax implications and reporting obligations for both employers and employees

- Volatility of token prices in the market

- Security and custody of tokens

- Difficulty proving income when obtaining credit facilities with traditional financial institutions

Thus, Web3 companies need to carefully design and implement their token compensation plans, and to comply with the legal and regulatory frameworks in their operating regions.

Why should I pay for a token vesting software?

Finance and talent managers at Web3 teams spend extraordinary amounts of time on inefficient, manual processes for distributing tokens to employees and investors.

Using Excel spreadsheets and other makeshift methods for tracking vesting schedules can often lead to delays, or costly mistakes. The inability to sell tokens due to missed or delayed transfers can also create unhappiness among Web3 teams.

Token vesting and management software can help to simplify and automate token-based compensation in the following ways:

- Manage token launches, token generation events (TGE), and token sales on a single platform

- Automatically distribute tokens based on custom vesting schedules without writing custom smart contracts, or manually transferring tokens

- DeFi integrations to automatically transfer vested tokens to DeFi products for liquidity provision, staking, or yield farming as they are vested over time.

- Simplify your audit trail, tax reporting and tax withholdings on tokens disbursed.

- Real-time dashboards give employees and investors visibility into their tokens and vesting schedules, and save time answering administrative questions on token distributions.

- Centralize your legal agreements like SAFTs, and other key documents for investors.

- Provide a unified platform for governance token holders to vote on proposals.

- Easily view your token cap table in real time, and monitor transactions of your token by major holders.

- Facilitate secondary market trading of tokens among pre-sale investors.

- Implement KYC/AML, or security token transfer restrictions.

Bear in mind that not all token management platforms offer all of these features and functionalities. Even when they do, there may be key differences in the specifics of the same features.

Key criteria for evaluating token vesting platforms

When choosing a token vesting platform, Web3 companies should consider the following criteria:

Compliance: The solution should comply with the relevant tax and securities laws in the jurisdictions where the company and its employees operate. The solution should also provide clear and accurate reporting of token transactions and balances.

Security: The solution should ensure the safety and integrity of the tokens stored or transferred. The solution should use secure encryption methods, smart contracts audits, or reliable custody providers.

Flexibility: The solution should allow the company to customize its token vesting plan according to its specific needs and goals. The solution should support different types of tokens, vesting schedules, cliff periods, milestones, beneficiaries, etc.

User-friendliness: The solution should be easy to use and understand for both the company and its employees. The solution should have a simple and intuitive interface, provide clear instructions and guidance, and offer responsive customer support.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.