U.S. Federal Reserve: Crypto Payments Serve Lower-Income, Unbanked Families

A new report just published by the U.S. Federal Reserve admits that crypto payments are more likely to be being used by Americans who are left out of banking and credit facilities.

A new report just published by the U.S. Federal Reserve admits that crypto payments are more likely to be being used by Americans who are left out of banking and credit facilities.

For millions of people around the world, traditional banking and payment services are the least accessible to the people that need them most.

Financial inclusion is a topic many might associate with less developed countries in Asia or Latin America. But an estimated 6% of the adult population in the United States, or about 15.5 million individuals did not have a bank account, according to the latest U.S. Federal Reserve’s annual survey of American households’ economic well-being.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

How Crypto Is Serving Low-Income Families

While central bank officials are typically critical of cryptocurrencies — the Fed’s own report concedes they're especially popular among unbanked Americans. As the report notes:

"Nearly 6 in 10 adults who used cryptocurrencies for transactions had an income of less than $50,000. A far lower 24% of transactional users had an income of more than $100,000."

According to the Fed’s figures, despite an estimated 12% of American adults holding or using cryptocurrencies in 2021, only about 2% used crypto to pay for purchases, with 1% using it to send money to friends or family.

But while the transactional use of cryptocurrencies was relatively low, Americans using cryptocurrencies for purchases rather than as investments were more likely to be left out of the traditional financial system.

Nearly 13% of adults who used cryptocurrency for purchases or money transfers did not have a bank account or credit card. This ultimately highlights how crypto is becoming increasingly popular among segments of the population that traditional financial institutions are failing to serve.

Powering The Decentralization of Work

Apart from serving those without access to traditional banking and payment services, crypto is also helping to create greater financial inclusion by decentralizing access to remote work opportunities.

The trillions of dollars in investment and venture capital funding which have flowed into the crypto markets, combined with the normalization of remote work during the global COVID-19 pandemic has led to a mushrooming of DAOs, and remote-first web3 companies.

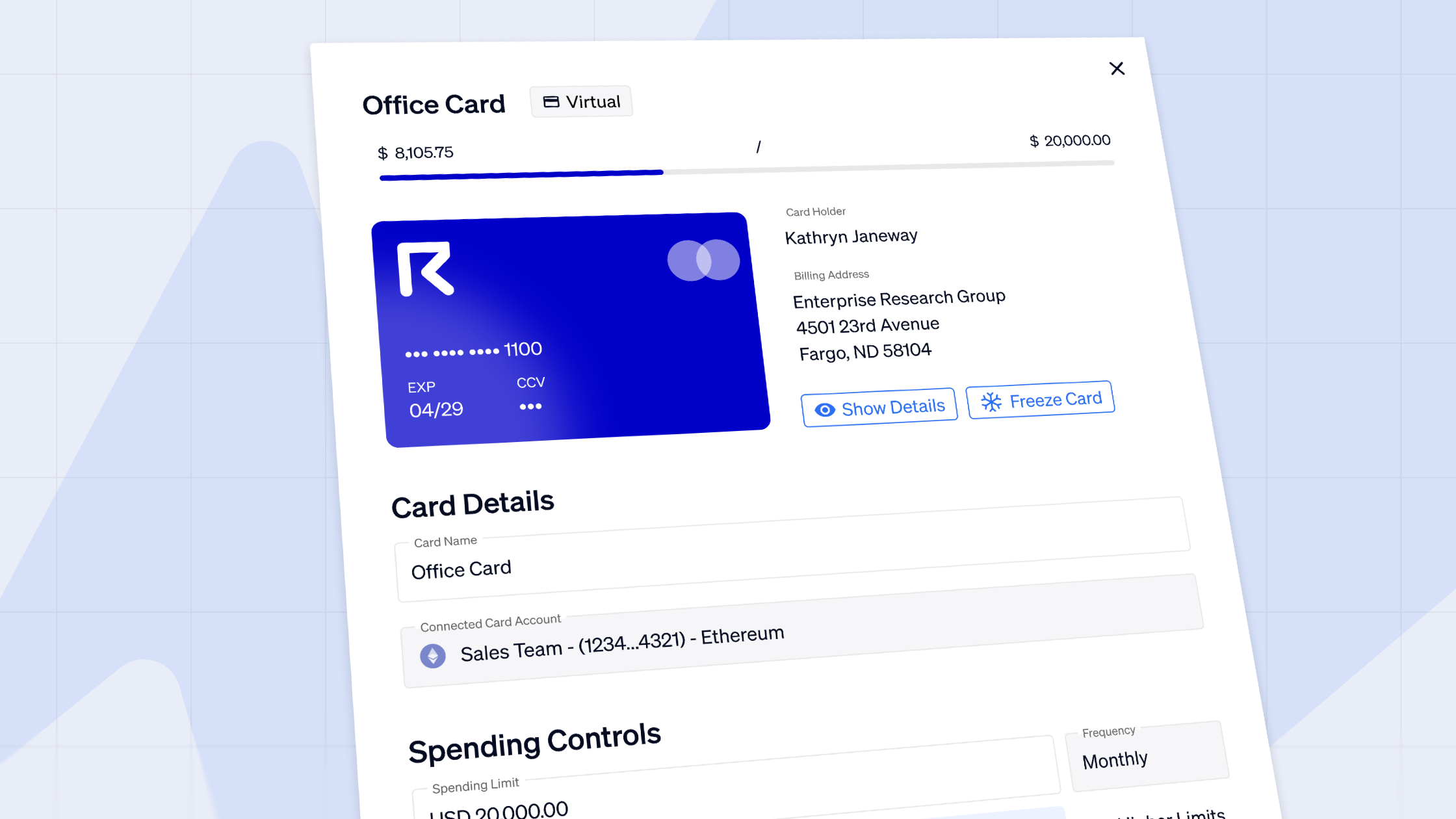

Additionally, crypto payments offer these companies a cheaper, faster, and easier way to manage their global payroll. Today, more than 1,700 companies have used Request Finance to pay their global teams of employees, contractors, and service providers an estimated $200m in tokens and stablecoins.

This has led to a spike in the number of job openings that accept applications from candidates located anywhere. According to figures published by Indeed in 2021, the success of the cryptocurrency industry resulted in a 118% jump in career postings for work in the field from 2020. The rise of remote work opportunities in web3 eliminates the geographical barriers that would have ordinarily limited the options available to jobseekers.

Join the Web3 Revolution

As a remote-first team of over 20 people working remotely across nine different countries, Request Finance is no stranger to how crypto enables the democratization of access to labor markets.

Find out how you can join the team, and help us simplify crypto payments for web3 companies.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.