Why Crypto-to-Fiat Transactions are Disrupting Conventional Payment Methods

Discover how crypto-to-fiat transactions offer speed, transparency, and accessibility, outclassing traditional wire transfers and centralized exchanges.

Global businesses need payment solutions that are quick, cost-effective, and universally accessible.

Crypto-to-fiat conversions have surfaced as an alternative to conventional methods like wire transfers and centralized exchanges.

Here's why:

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

1. Near-instant transactions

The essence of any business lies in its ability to complete transactions swiftly.

Traditional wire transfers can take up to several days to clear, particularly for cross-border payments involving intermediary banks.

For instance, the recent collapse of Silicon Valley Bank caused Wrapbook’s payroll processing delays.

Also, nearly half of all suppliers experience delayed payments, which can disrupt your company’s cash flow.

Centralized exchanges are slightly quicker but still don't offer immediate transactions.

On the other hand, crypto-to-fiat transactions are executed in real-time or near real-time, cutting down waiting times dramatically.

This speed brings a competitive advantage to your business, especially when dealing with time-sensitive opportunities or markets.

2. Transparent, lower fees

Traditional payment methods are notorious for their hidden fees.

Banks can siphon off up to 10% of the total transfer amount in fees.

Wire transfers can come with charges that are buried in the foreign exchange rates, causing the transaction cost to balloon unexpectedly.

Centralized exchanges are slightly better in terms of fee transparency but usually charge a premium for fiat withdrawals.

Crypto-to-fiat conversions, however, typically offer a fixed, transparent fee structure, making it easier for your business to calculate costs and manage budgets.

3. Global teams need global payments

Traditional financial services are often gated by geographic limitations and banking relationships.

Being digital currencies, cryptocurrencies are within reach for anyone with internet connectivity, amplifying the scope for broader financial participation.

When businesses adopt crypto payments, they unlock access to previously untapped markets, paving the way for both business growth and social inclusion.

Additionally, the ongoing transformation towards remote work is significantly altering the landscape of the global labor market. This change becomes increasingly relevant for enterprises aiming to capitalize on a diversified, international talent pool. The acceptance of remote work models, coupled with the growing digitization of society, lays the foundation for businesses to engage with skilled professionals from regions traditionally deemed unreachable.

Traditional banking structures often serve as a roadblock for hiring talent in financially underserved locales. The lack of established financial infrastructures in some areas creates substantial challenges for companies intending to compensate their global workforce.

Crypto-to-fiat fills this gap by providing a streamlined and trustworthy avenue for cross-border value exchange, that allows employees and businesses to off-ramp to fiat in a single transfer.

Imagine a tech firm headquartered in San Francisco, facing a scarcity of local talent skilled in blockchain and Web3 technologies. They opt to scout for remote employees from financially underserved areas, such as select regions in Africa, Southeast Asia, or South America.

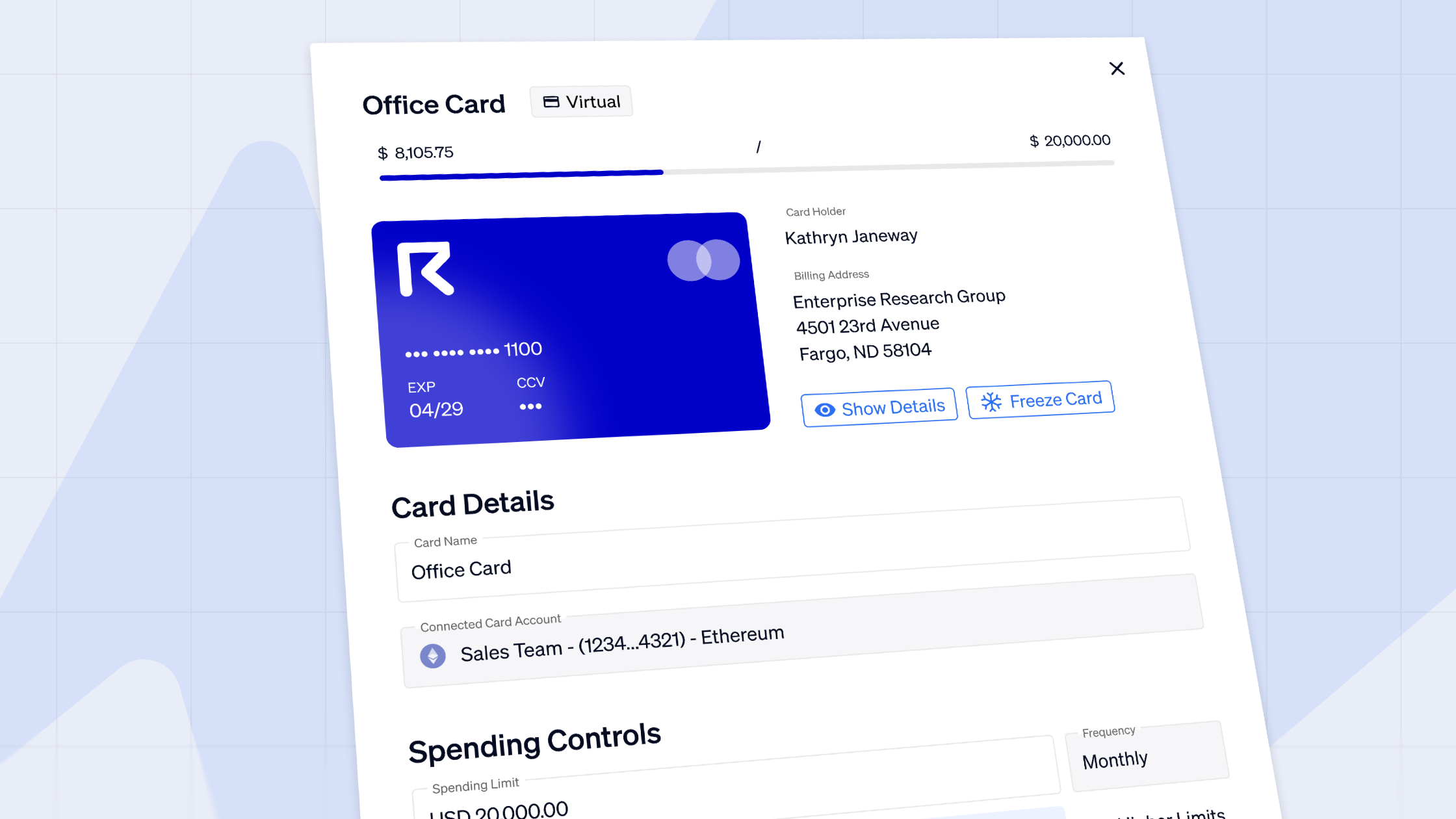

By deploying the crypto-to-fiat feature on Request, the company can effortlessly execute crypto payments to their international team members, while they receive fiat in their bank account.

4. Improved cash flow management

Businesses that engage in international trade or have globally distributed teams know the pains of managing cash flow across different currencies and bank accounts.

The delay in fund clearance in wire transfers and even centralized exchanges can hamper liquidity.

Crypto-to-fiat transactions allow for almost immediate conversion from crypto to fiat currencies. This improves liquidity and enables better cash flow management, especially critical for businesses operating on thin margins or requiring quick access to funds.

Concluding thoughts

Crypto-to-fiat offers unparalleled advantages over traditional methods like wire transfers and centralized exchanges in terms of speed, cost, and accessibility.

The importance of efficient and reliable payment systems can't be overstated, especially if you’re a global, distributed team.

Crypto-to-fiat is a powerful tool to meet these payment challenges head-on.

Ready to use crypto-to-fiat in your payment operations? Get started today.

👉https://app.request.finance/pay/crypto-to-fiat

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.