Roles & Responsibilities of a Web3 CFO: Mastering Operations, Compliance, Strategy

Understand the transformative role of a CFO in a Web3 context. Learn about managing operations, ensuring compliance, and forming strategic insights.

Discover more actionable insights from finance and operations professionals at leading Web3 companies, DAOs, and Foundations by downloading our Web3 CFO Guide.

Being a crypto CFO in a rapidly growing crypto company, DAO, or Foundation presents immense opportunities. Defining your role involves identifying the most crucial activities and finding ways to add value in those areas.

As a crypto CFO, your responsibilities encompass three domains: operations, compliance, and strategy.

Let's explore each of these in detail while highlighting the significance of the crypto CFO role in the evolving Web3 landscape.

1. Operations

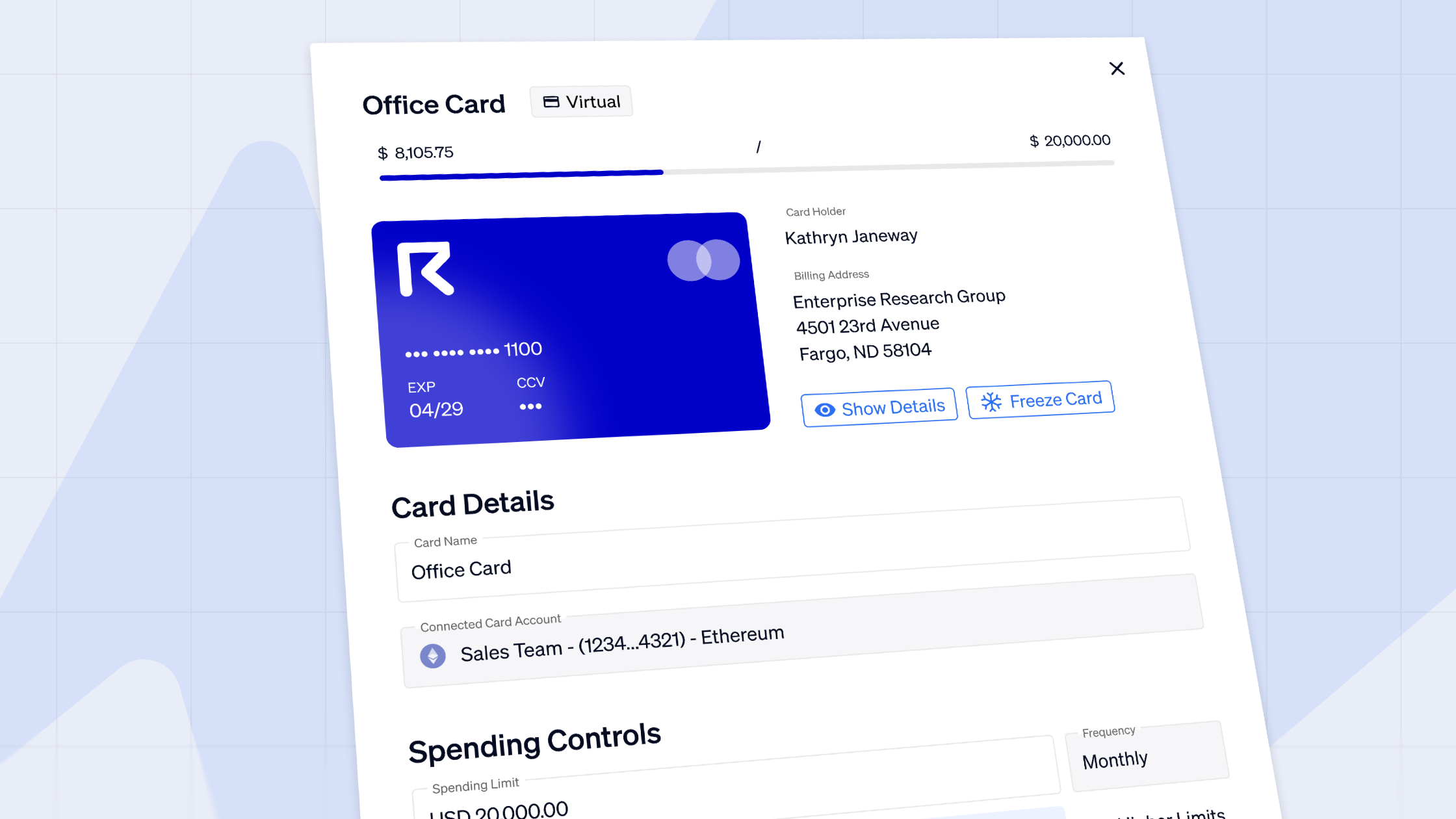

In the operational domain, the finance function ensures that ongoing operations run effectively; in support of other business functions such as paying talent, or processing expenses incurred by the sales & marketing team.

The complexity of arcane financial systems means that breakdowns in financial operations occur with alarming regularity, even at some of the world’s largest corporate giants. Citigroup is in the midst of a multi-year effort to update its underlying controls and technology after U.S. regulators slapped it with a $400-million fine for deficiencies in both areas. Famously, Citigroup’s outdated systems also led to the accidental, and irreversible, payout of nearly a billion dollars to various hedge funds in 2020.

These existing difficulties of managing financial operations in fiat are compounded by the growing acceptance of cryptocurrencies as a payment method. This nascent asset class adds a new dimension of challenges but also of potential upside for companies’ cash reserves, which are driving more companies to desperately seek tools for managing such asset classes.

CFOs who have successfully established finance functions at their companies have shared their experiences and insights through webinars, providing valuable knowledge on the challenges faced and the emerging toolkit available to overcome them.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

2. Compliance

In the post-FTX era, there is also a renewed focus on the role that crypto CFOs can play to provide visibility into an organization’s financial health, and assurance to stakeholders by ensuring compliance with tax, accounting, and other regulatory requirements.

FinOps tools in Web3 like Request Finance can help crypto CFOs to shape the way businesses manage their money by automating, and optimizing existing workflows while giving the entire organization a real-time view of their financial health.

By automating repetitive tasks and offering optimization capabilities, these tools free up valuable time and resources, allowing CFOs to focus on higher-level strategic initiatives that drive growth and profitability.

3. Strategy

The role of a crypto CFO extends beyond operational tasks and cost control. It also encompasses strategic responsibilities such as exploring avenues for profitability, generating measurable value, and establishing or enhancing critical processes. The evolving landscape of financial technologies has elevated the role of crypto CFOs to a more strategic level in recent years.

In Web2, there has been considerable excitement around how companies can offer “embedded finance” services within their own platform. In Web3, the range of novel financial services and instruments are endless.

Empowered with new Web3 primitives, crypto CFOs can also drive significant revenues with various yield-bearing treasury management instruments, open up new revenue streams and customer engagement touchpoints with NFTs, or help increase customer retention with novel payment tools.

Web3 organizations deserve, and need better software tools to help finance and operations teams manage their day-to-day finance workflows. Automation of repetitive processes like payments, and integrations with other applications in both Web2 and Web3 are key to simplifying FinOps for Web3 teams.

These tools can also empower crypto CFOs to add strategic value through better visualization and reporting of the organization's crypto asset values, and cash flows across different chains, token types, and platforms.

Blockchain technologies can allow every Web3 organization to have the transparency of a publicly-listed company. In some ways even more so, with the ability to monitor finances or mark assets to market values in real time, rather than quarterly.

As better tools and processes emerge, Web3 organizations can distinguish themselves not only on the basis of other business fundamentals, but also in how well their financial operations are run.

Despite the challenges faced by Web3 CFOs, many remain optimistic about the increasing demand for finance professionals in the blockchain space. In a survey involving more than 250 finance and operation professionals from leading Web3 companies, 76% of crypto CFOs anticipate a growth in demand for finance, accounting, tax, and audit professionals over the next 12-24 months. This indicates the expanding opportunities for finance experts in Web3.

Shaping the Next Generation of Financial Operations

There’s a growing demand for entrepreneurs to develop cutting-edge software tools for the future of financial operations. These next-generation tools go beyond traditional payment management and bookkeeping functions. They have the potential to revolutionize financial operations, transforming them from a cost center into a revenue driver for organizations.

In the near future, crypto CFOs will have convenient access to embedded financial services such as invoice factoring, credit scoring based on decentralized identity, smart contract-based escrow services, and advanced treasury management solutions. These services will enhance efficiency, reduce costs, and provide new avenues for generating revenue.

It’s imperative for key players in this emerging space to collaborate and construct a new payments infrastructure.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.