Doing Business with Crypto: the Brief How-to Guide for Small Businesses

How to do business in crypto for small businesses? Here are the steps, tools, benefits, and precautionary measures to consider when getting started.

Companies are increasingly doing business with crypto - and for good reason too. From cheaper and faster remittances, to improved invoice financing and treasury management, more small businesses are realizing the unique, attractive benefits that doing business with crypto can generate. Although, there are also risks for small businesses to be aware of.

In this article, we’ll discuss why doing business using crypto is growing and what your own company needs to know to use crypto effectively, while also protecting itself from risks.

This article covers:

- - Four benefits of doing business in crypto

- - Two main ways to use crypto in your company

- - Three crypto tools that all small businesses need

- - Effective crypto risk management

Over 15,000 businesses worldwide accept Bitcoin, including prominent organizations such as Microsoft and AT&T. Meanwhile, Ether is also accepted by an increasing number of companies, including Shopify and Overstock. But of course, it isn’t just large companies that are using crypto to do business. Small businesses are too.

These companies, large and small, have embraced cryptocurrency because they have identified one or more benefits that it can bring, which fiat currency like the US dollar or euro cannot. As crypto continues to make inroads towards becoming a fully fledged mainstream investment asset class and form of digital currency, the number of companies that adopt it as part of their business model is only set to increase.

4 benefits for small companies of doing business with crypto

There are numerous opportunities and benefits that doing business in crypto offers.

1. Transaction speed and cost

A Bitcoin transaction takes, on average, between 10 and 20 minutes, from any point in the world to another. An Ethereum transaction usually takes a few minutes. In comparison, conventional international bank transfers that use the SWIFT network typically take anywhere from one to five days, although in some cases, it can take weeks for a transaction to clear.

With crypto, you can do business immediately and borderless with vendors and customers in other parts of the world. What’s more, transaction fees even using tokenized fiat currencies like USDC or DAI can often be far lower than traditional payment gateways like Wise, and PayPal.

2. Improved returns on liquid assets

Particularly in 2021, cryptocurrency has seen a massive increase in interest from institutional investors across the globe, including banks such as JP Morgan and Goldman Sachs. JP Morgan is also an example of a major bank that has also been working on launching its own crypto investment fund.

By holding some of your company’s liquid assets in crypto, you can earn yields averaging 10% per annum, paid regularly - well in excess of fixed income securities. Decentralized finance (DeFi) smart contract platforms which automatically lend out your cryptoassets through collateralized loans over short periods. This is far better than keeping cash in a bank account, most of which offer zero or near-zero interest rates, while inflation makes cash lose value year on year.

Crypto assets can also be viewed as an alternative investment option to conventional assets like stocks and bonds. While volatile, the tremendous gains over time among the major cryptocurrencies can provide good diversification to your cash holdings. Bitcoin’s 2020 Q1 bull rally saw the asset climb in value from under $30,000 to over $60,000 by April.

3. Appeal to younger, tech-savvy customers

Your customers are increasingly digital natives, and crypto is fast becoming a core part of the way they live, work, and play. The Millennial and Generation Z cohorts will soon be the two most dominant in terms of spending and investment power. Companies who offer as much flexibility and familiarity with crypto will be more relevant than your competitors who don’t.

Moreover, the crypto market cap already surpassed the $2 trillion mark in early 2021 and there are approximately 100 million Bitcoin owners, demonstrating the rapid growth in, and enormous potential for, crypto assets. This is especially the case when we consider that cryptocurrency is still very much in its infancy, with Bitcoin launching a mere 12 years ago in 2009.

4. Give yourself a head-start as fiat currencies become tokenized

Digitalization is already transforming practically all industries. Fintech has driven digital transformation of the financial industry over the last ten years. Customers are increasingly expectant that companies are ahead of the curve when it comes to new and innovative ways of doing business. Whether sooner or later, choosing not to do business in crypto could place businesses at a competitive disadvantage.

Central banks are already discussing creating digital versions of their countries’ national currencies. These include the US Federal Reserve, the Bank of England, and the European Central Bank.

Here’s how you can stay ahead with crypto.

Two main ways to use crypto in your company

1. Payments

More payments in crypto mean less exposure to credit card processor fees. With Bitcoin as an example, there is no central party processor fee. Other benefits include less exposure to chargeback fraud risk, greater access to overseas markets, and by offering more payment options, you open your company up to more sales opportunities.

The most straightforward method of adopting crypto payments is to convert accounts receivable into fiat currency immediately through a crypto exchange. This means that your business’ balance sheet remains only in fiat currency.

This is a good option if you want to simply offer customers the option to pay in crypto and, crucially, so you are able to market yourself as a crypto-friendly company. It’s also a good idea if you want to get up and running with crypto before really integrating it on a deeper level into your business.

2. Treasury Management

Companies ready to integrate crypto beyond merely accepting payment in crypto can also consider converting some of their cash holdings into stablecoins, which can be deposited with exchanges, or DeFi smart contracts that generate higher yields.

For instance, you could convert some of your current cash reserves into USDC stablecoin, which are pegged at a roughly 1:1 exchange rate with the USD. You could then either lend those out via crypto exchanges, or deposit them into established DeFi platforms such as Curve.fi, or Compound.

To enjoy these benefits though, your business has to understand how to incorporate crypto from a treasury and accounting perspective as well as other critically important factors like regulatory compliance and defining limits to often high price volatility.

Three crypto tools that all small businesses need

Your business will need three types of foundational tools: (i) a crypto exchange, (ii) a crypto wallet(s), and (iii) a crypto invoicing system.

1. Your crypto exchange

Some of the biggest names in crypto exchanges, like Coinbase and Binance allow businesses to exchange many kinds of cryptocurrency, including the big two - Bitcoin and Ether - as well as many alt-coins like Litecoin, Dogecoin, and others. We recommend you conduct a thorough benchmark analysis to identify the exchange that fits your business’ needs.

2. Your company’s crypto wallet(s)

Cold and hot wallets both offer their own advantages and disadvantages over each other. As cold wallets are offline, you significantly lower the risk of digital fraud and online theft, for instance, but you are exposed to other risks, like losing it or having it stolen.

Again, we recommend a deep dive into the kind of wallet that is best for your business’ requirements. At Request, we've conducted a survey amongst our users and community to find out some of the best apps and practices to manage crypto assets in a company. Some companies choose to use multiple wallets, which can also be a mix of both hot and cold, in order to spread holdings across multiple locations, akin to how companies might keep US dollar or euro holdings in various different bank accounts.

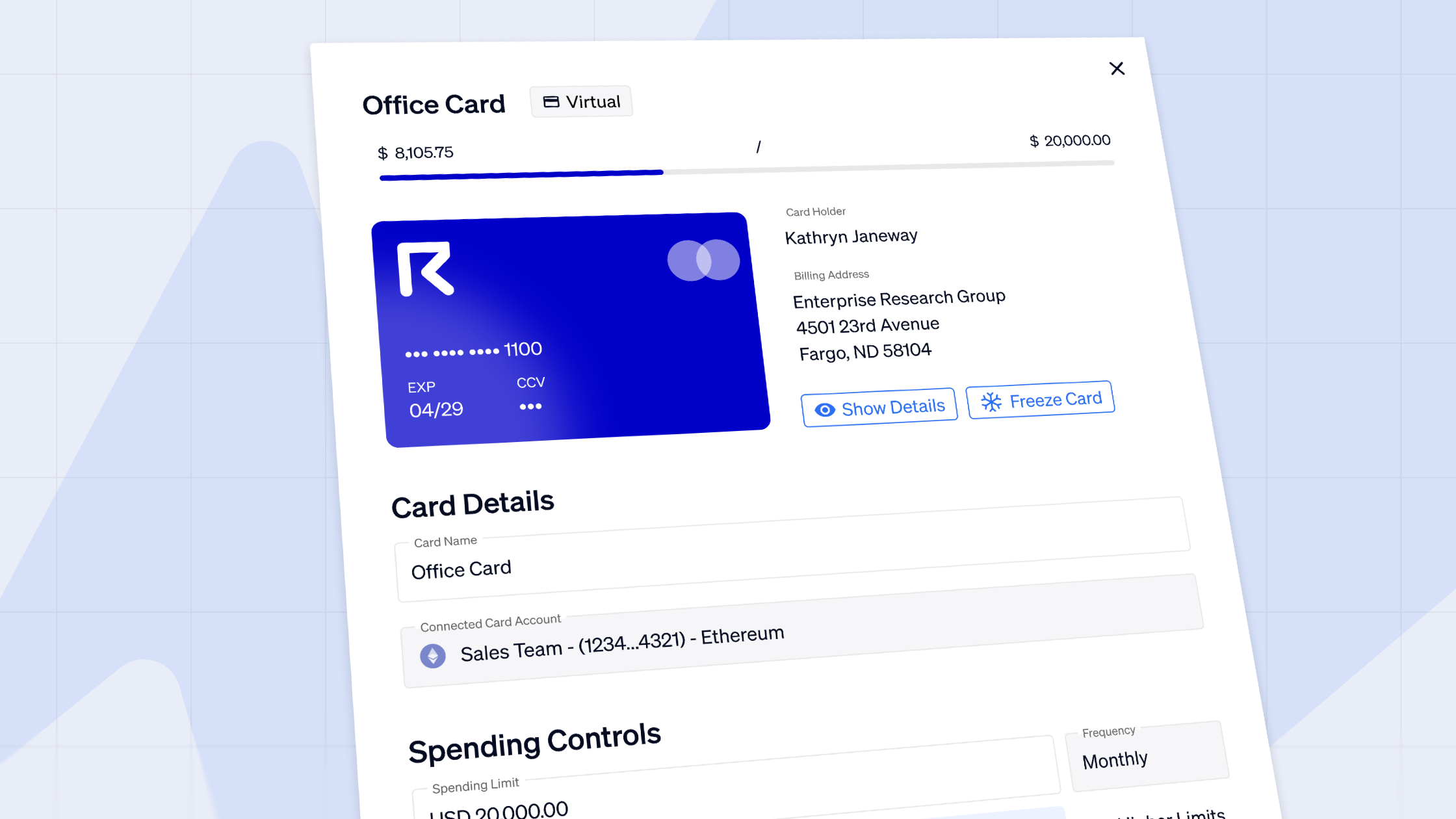

3. Your crypto invoice manager

Issuing invoices in crypto needn’t and shouldn’t be difficult. But, understandably, many companies are put off by how complex it may seem from the outset.

Request Invoicing is a purpose-built crypto invoicing system that enables your business to pay and get paid in crypto while also being fully compliant with relevant regulatory frameworks and laws.

These three types of tools will position your business to get up and running with crypto as a part of your operations.

Managing the risks of doing business in crypto

Like with fiat money, businesses must comply with anti-money-laundering (AML) and know-your-customer (KYC) laws that are in place to prevent financial terrorism and financial crime when receiving or sending payment in cryptocurrency. This includes being able to identify exactly the source of crypto-denominated payment or where payments are being sent to. One way to avoid being caught up with dodgy transactions is to avoid the use of peer-to-peer markets, and instead transact on open markets.

Crypto wallets also present some risks to prepare for. These include the danger of theft, whether from a cold or hot crypto wallet, and others, such as forgetting access keys, sending crypto money to the wrong beneficiary address or for the wrong amount.

The danger of the latter issue was recently seen when BlockFi, the crypto exchange, accidentally sent one customer 700 bitcoins, worth millions of dollars, instead of 700 US dollars. Your business can take measures to offset such risks, by automating your crypto payments using a tool like Request Invoicing, which can allow batch payments to suppliers and customers based on their email addresses.

Becoming a crypto-friendly company: final thoughts

Doing business with crypto offers your business a host of important benefits, including the opportunity for improved returns on liquid assets like cash reserves, boosting your brand image, and positioning your company for the arrival of digital currencies. However, like with “normal” money, there are risks too. To really tap into the power of crypto and unleash its benefits, at Request we recommend your company carry out research into what it means for all departments and how to implement processes to ensure efficient crypto operational workflows as well as full regulatory compliance.

Ready to Supercharge Your Crypto Accounting?

Stop wasting time, manually creating journal entries. Automate your accounting now, and enjoy error-free reporting

Learn how to scale your company's crypto & fiat financial operations

Your financial complexities are our specialties. Schedule your free consultation today and discover how Request Finance can transform your financial operations

Simplify crypto and fiat financial operations today

Rely on a secure, hassle-free process to manage your crypto invoices, expenses, payroll & accounting.

Crypto finance tips straight to your inbox

We'll email you once a week with quality resources to help you manage crypto and fiat operations

Trending articles

Get up to date with the most read publications of the month.

Our latest articles

News, guides, tips and more content to help you handle your crypto finances.